2024

CARBO Ceramics is proud to mark its 45th anniversary as a pioneering force in the field of ceramic technology. Over the past four and a half decades, CARBO has consistently demonstrated a commitment to innovation and excellence, solidifying its position as a leader in the industry. This milestone celebration serves as a testament to the company’s unwavering dedication to pushing the boundaries of technology to meet the evolving needs of its clients. CARBO’s cutting-edge ceramic solutions have played a crucial role in enhancing the efficiency and sustainability of various industries, ranging from oil and gas to industrial manufacturing. As they reflect on their remarkable journey, CARBO Ceramics remains at the forefront of technological advancements, poised to continue shaping the future with groundbreaking solutions that redefine industry standards.

CARBO has launched CARBOISP Lite, a disruptive lightweight product that outperforms traditional ISPs in many performance characteristics. This enables customers to use less product, placing proppant easily while creating reliable fractures and minimizing carbon emissions by more than 80%

2023

CARBO launched CARBOTRACE which will enable energy operators to improve their reservoir performance by optimizing drilling and completions designs through understanding the production inflow profiling. The use of the technology reduces the overall cost of the well’s ownership, improves the carbon footprint for the well’s lifecycle and boosts the decision-making of the E&Ps for their offset wells.

CARBOTRACE technology overcomes the limitations of current technology by providing a cost-effective production surveillance solution for multistage fractured completions.

Deployed with various proppants, CARBOTRACE offers a quantitative analysis of the percent contribution of each frac stage’s oil, water and gas phases. CARBOTRACE enables quick decision-making based on reliable production data.

CARBO received an International Business Award for Energy Industry Innovation of the Year for launching CARBOTRACE.

CARBO received a prestigious Spotlight on new Technology Award for launching CARBOTRACE.

CARBO's leadership was recognized at the International Business Award with a Management of the Year nomination

CARBO's announcement. CARBOTRACE received Innovation of the Year award

2022

CARBO announced the appointment of Shannon Nelson as the new CEO.

He previously served as Vice President of manufacturing and distribution, overseeing all Manufacturing operations throughout CARBO. Shannon holds a bachelor’s degree in accounting-business administration from Georgia College.

With his extensive industry experience and tenure with CARBO, Shannon leads strategic initiatives to achieve the company's goals and success.

Terry Palisch is the vice president of technology and engineering at CARBO Ceramics in Richardson, Texas. He began his career with ARCO, during which he served 4 years in Algeria and 10 years as a senior petroleum engineer in Alaska. Palisch joined CARBO in 2004 and in his current position leads a team of technologists developing and championing new products and services and advising clients on completion and fracture optimization.

Palisch has been an active SPE member serving in various roles in the past, including past Chairman of the SPE Dallas Section, past Chair of the SPE Annual Technical Conference and Exhibition (ATCE) technical program and SPE Completions Technical Director. He is an SPE Distinguished Member and received the award for Distinguished Service, as well as the SPE Mid‑Continent Regional Completions Optimization and Technology Award and the Regional Service Award.

In 2013, he was named one of the Top 15 Best Engineers by the Texas Independent Producers and Royalty Owners Association, and in 2015 he was named the SPE Dallas Section Engineer of the Year. He has authored more than 50 SPE technical papers and holds several patents.

Palisch holds a bachelor’s degree in petroleum engineering from the University of Missouri‑Rolla (now Missouri University of Science and Technology) and was recently recognized as a Distinguished Alumnus.

‘Pinnacle of proppant’

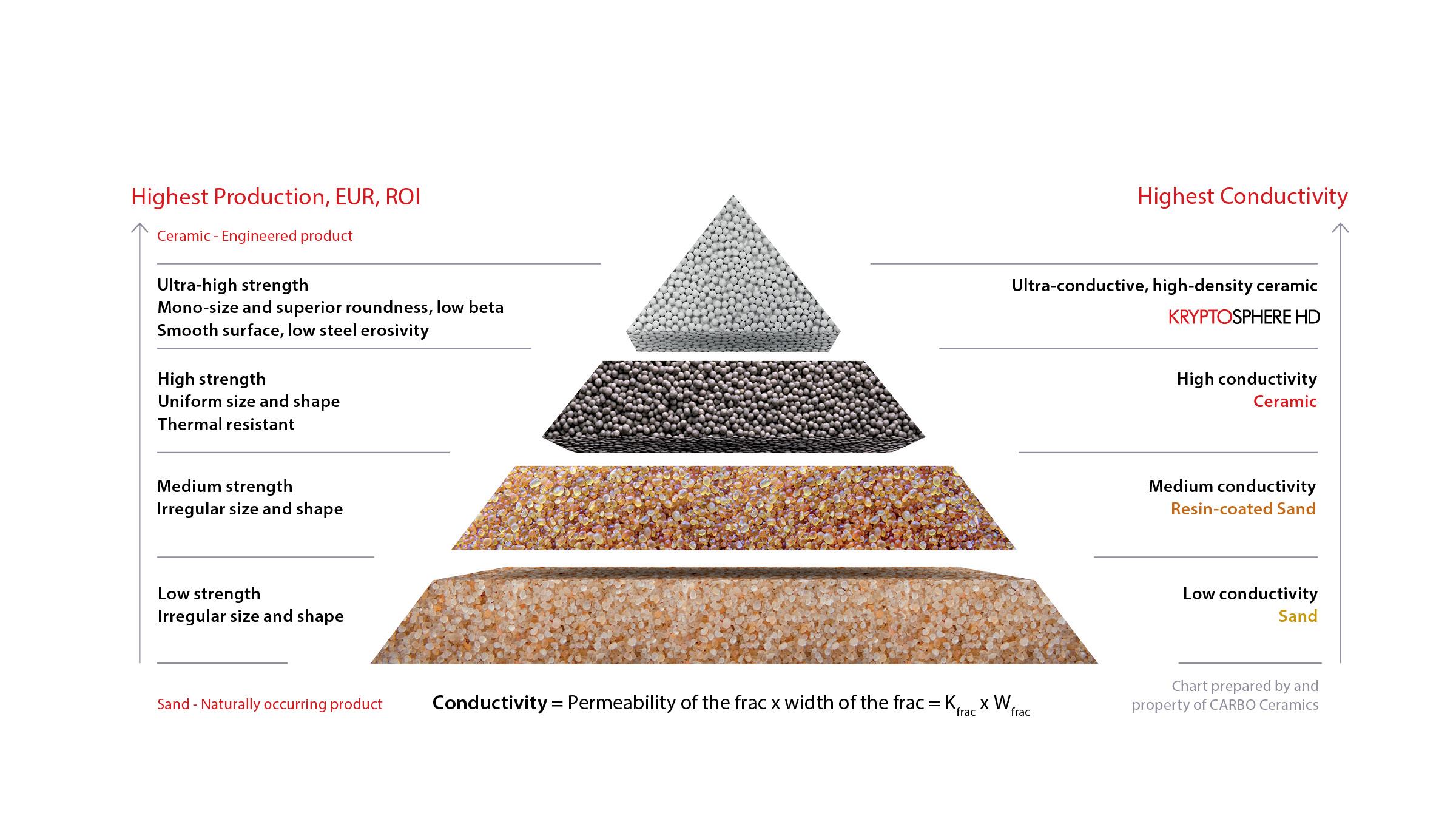

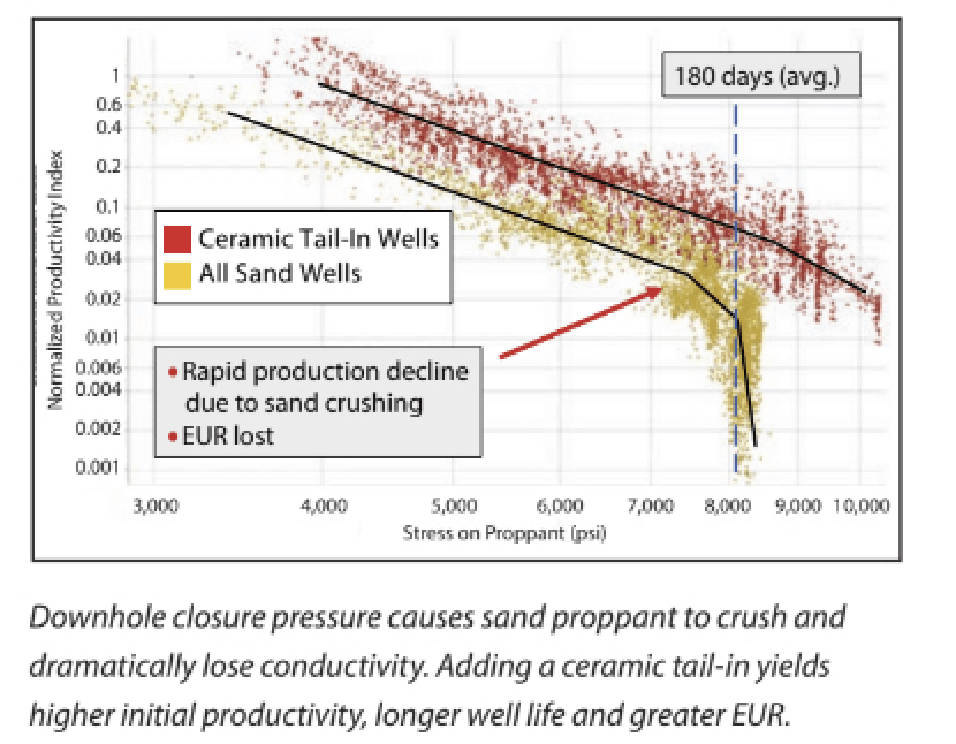

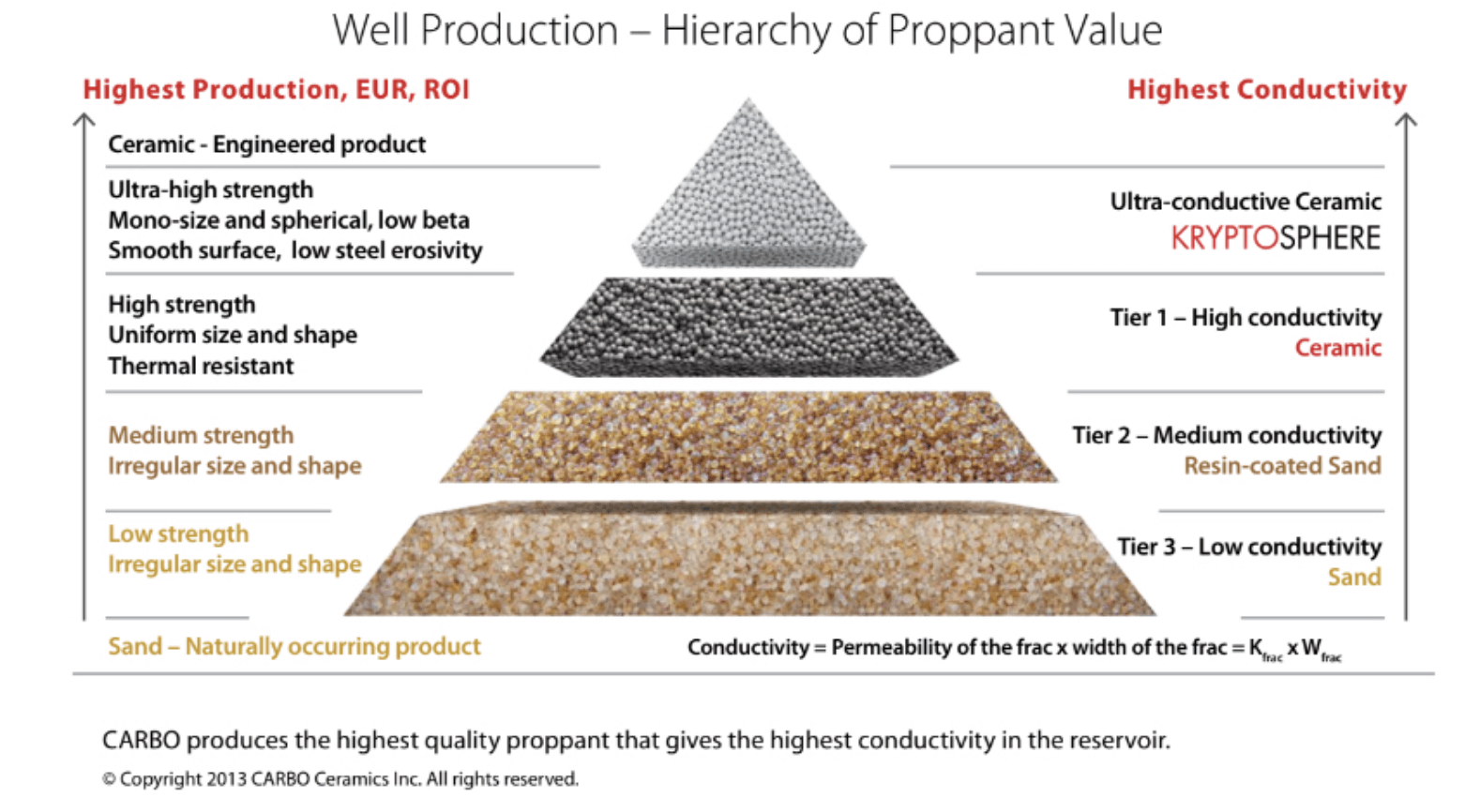

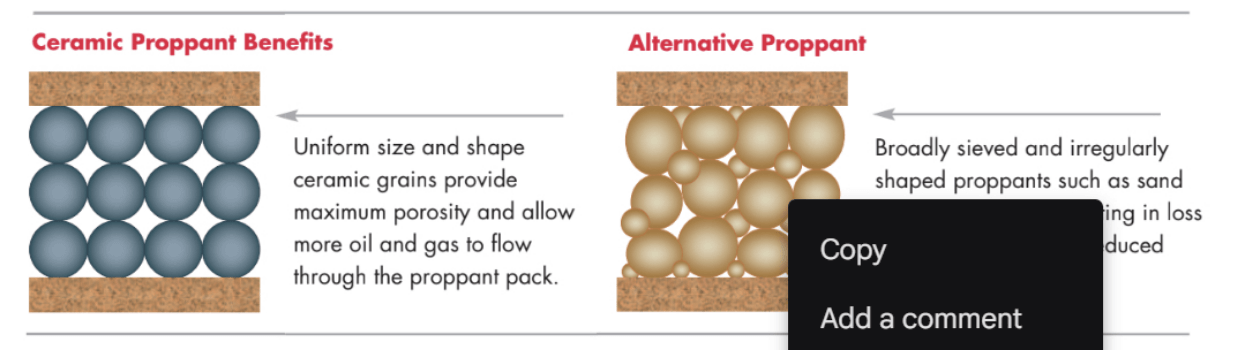

The choice of a proppant can be one of the most important decisions producers make when fracking a well. Despite the strength of different varieties of frac sand, ceramic proppants are the strongest and most conductive option.

“Your choice in proppant is really what’s going to dictate the long-term performance of the well,” Josh Leasure, director of sales at CARBO, told Hart Energy. “If you’re going to create a long-term well, ceramic proppant is your answer.”

Josh Leasure, director of sales at CARBO.

CARBO is a technology company that features a wide variety of high-tech ceramic and resin-coated proppants. Among those products is the KRYPTOSPHERE, which Leasure calls “the pinnacle of proppant.”

“The manufacturing process is what dictates how good [our] products are,” he said. “We pride ourselves on the manufacturing process and how we’re able to get rid of the weak points within those proppant grains.”

Each proppant under CARBO’s KRYPTO umbrella (KRYPTOSPHERE, KRYPTOAIR and others) is ultra-conductive and suitable for high-closure stress environments. Each grain is the same shape and size, maximizing the flow of production through the fracs. Offerings from CARBO can also be modified to fit the specific needs of producers. Even the non-KRYPTO options have higher thermal stability and conductivity than natural sands being used.

Max Nikolaev, Senior Vice President of Sales at CARBO

“We’re not only providing the strength and the particle distribution the industry usually wants from the proppants. We add value to each grain and that value can be tailored to the issues or problems [operators] have,” Max Nikolaev, senior vice president of sales at CARBO told Hart Energy. “So, if you are running the assets that have scale issues, we can address that. If you need tracers, we can address that. If you have issues with the flowback, we can address that and many, many, many other problems.”

Ceramic proppants, such as the products CARBO creates, are mainly used for offshore fracking due to their expensive, yet highly effective nature. Brett Wilson, R&D manager at CARBO, says that because the volume of proppants is limited by how much will fit on a ship, producers need to squeeze as much oil out of an offshore well as possible.

While natural frac sand is slightly less effective in its ability to maximize the flow of production from a fracked well, it is widely used onshore, as it is typically much easier to acquire than most ceramics. Natural sands are also cheaper than ceramics, allowing for more sand to be used when fracking a well.

2021

CARBO’s VP of Energy Max Bran Nikolaev was recognized as rising technology influencer by HART Energy’s “40 under Fourty” contest.

Innovation is the lifeblood of the oil and gas industry. However, innovation requires invention. Invention requires ideation. Ideation requires inspiration.

The value of an idea is found in how it is used, as Thomas Edison, the inventor of the modern-day lightbulb and more, once noted. Ideas and all of their possible uses become reality when the brightest minds transform inspiration into innovation. In recognition of the oil and gas industry’s brightest minds, inventive innovators and rising stars of cutting-edge technology development, E&P announced the 2021 40 Under Forty recognition program.

These men and women should have demonstrated leadership and made significant contributions to advancing oil- and gas-related technologies. Their impact can be demonstrated by innovations that enhance (or have potential to enhance) a company’s mission or the industry’s long-term success.

Hart Energy 40 Under Fourty

2019

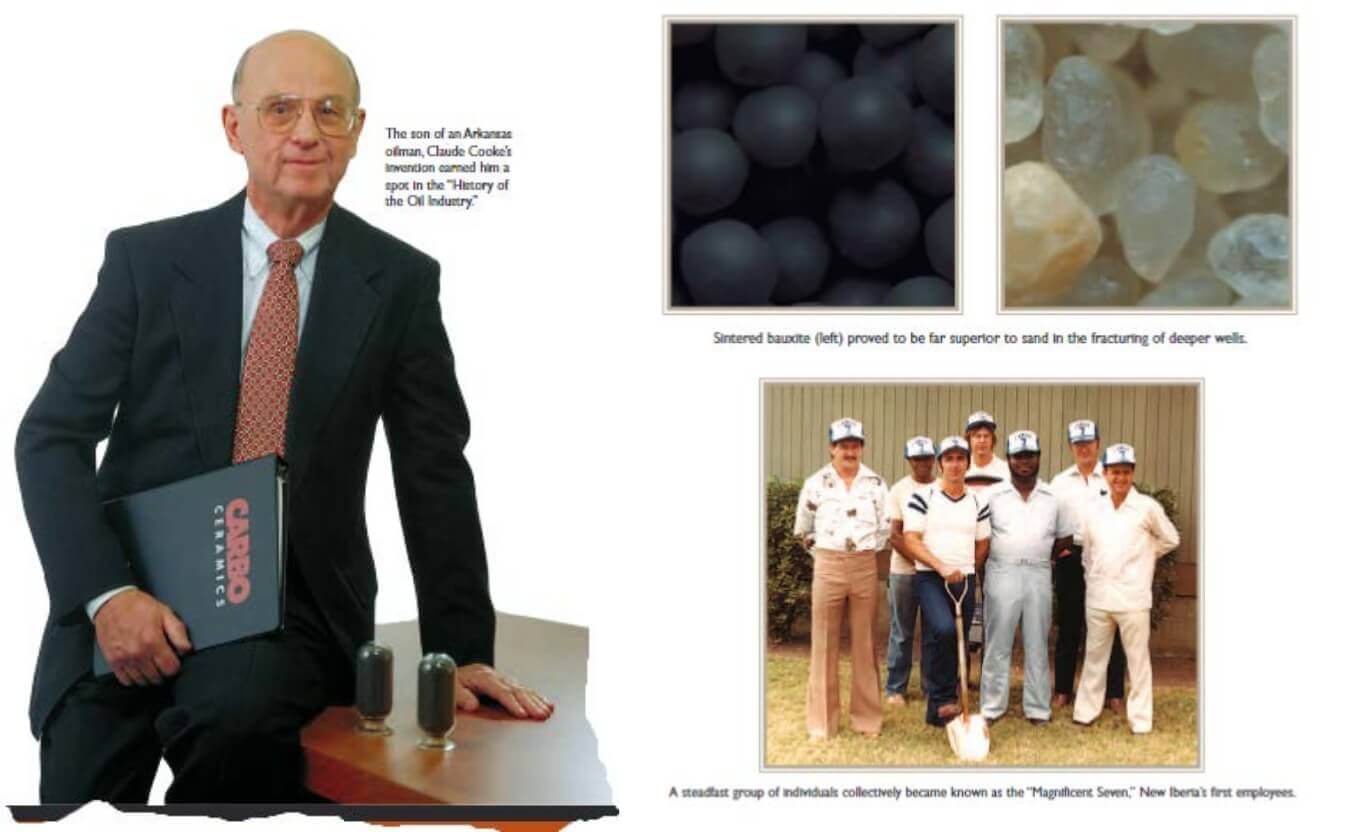

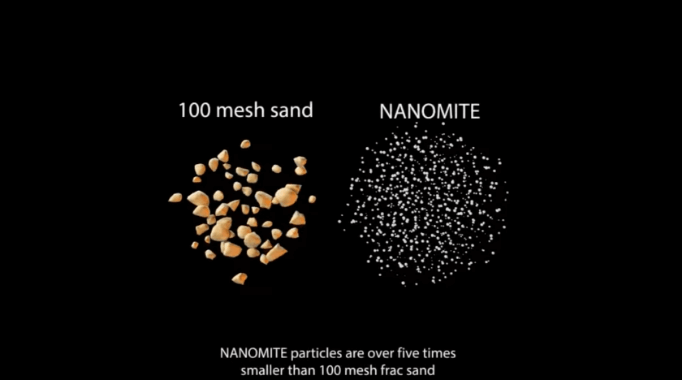

CARBO released NANOMITE, a ceramic microproppant that is a fraction of the size of the smallest proppant commonly deployed. NANOMITE alleviates perforation entry issues, improves cluster fluid distribution and maximizes contact with the reservoir. This improves stimulation efficiencies, reduces overall completion costs and improves production. NANOMITE is a cost effective, ideal solution for operators experiencing difficulty with proppant placement, elevated treatment pressure and early screenouts during treatment.

Traditional proppant is too large to fit into a complex fracture network’s microfractures, and its transport characteristics limit how far it travels into the area. The smallest particles of NANOMITE C are more than five times smaller than the smallest particles in 100 mesh frac sand. This allows the particles to prop open even the narrowest secondary fractures and microfractures, increasing overall production contribution from the reservoir matrix while lowering high surface treating pressures NANOMITE ceramic microproppant is used in the Northeast United States, North Rockies and Mid-Continent regions of North America, as well as its first use in Romania. Leading in with NANOMITE microproppant results in easier placement of the main fracture as well as propping open microfractures to improve long-term productivity.

Results from FUSION application in the Gulf of Mexico impressed the industry. A major Gulf of Mexico operator began using FUSION, a proppant pack consolidation technology that creates a bonded pack with or without closure stress, as they began drilling and completing injection wells again. Several additional wells are now planned. Additionally, designs using the technology for pack consolidation were approved for South America and for a novel application in Alaska.

2018

In 2018, CARBO successfully continued to execute its transformation strategy to diversify its business and reduce its reliance on the cyclical oil and gas industry. Through the effective execution of this strategy, CARBO generated increased revenue and a 139% incremental gross margin despite the downturn in the oil and gas markets in the second half of 2018. Base ceramic remains important, with contributions to consolidated revenue in 2018 at approximately 20%, while our growing industrial sector and environmental business contributed nearly a quarter of consolidated revenue.

The highlight of our transformation strategy was double-digit revenue growth in our technology-driven oilfield products, our industrial sector and environmental business. Continuing to effectively reduce costs and implement strategic structural changes, we sold our Millen, Georgia, manufacturing facility, and were able to lease under-utilized assets to other companies, which generated cash and recouped costs.

TECHNOLOGY DRIVES OILFIELD PERFORMANCE Revenue from our oil and gas sector, excluding prior year Russia proppant sales, increased 14% in 2018 compared to 2017, comprising approximately 78% of consolidated revenue. CARBO’s technology-rich oilfield products continued to grow and differentiate the company. Technology-driven products revenue increased 15% in 2018, led primarily by KRYPTOSPHERE® ultra-conductive proppant, CARBOAIR® ultra low-density proppant with exceptional transport characteristics, and CARBONRT®, our non-radioactive tracer.

A highlight of 2018 was the commercialization of SALTGUARD®, one of our unique production assurance technologies. SCALEGUARD® and SALTGUARD provide a long-term release of chemicals that prevent build-up of deposits which can restrict production and increase well work-over costs. STRATAGEN® consulting revenue increased 38% year-on-year. FRACPRO® fracture simulation software revenue increased 22%, primarily driven by new client growth.

INDUSTRIAL TRANSFORMATION AND GROWTH The transformation of our industrial sector was evident, with continued substantial growth in 2018 and a revenue increase of 24%. New industrial ceramic products were introduced to the portfolio, leveraging our technology by developing solutions that addressed specific industrial challenges while opening new market segments. The technical sales force was increased to support these products, resulting in the significant addition of new clients.

Increased sales of ACCUCAST® were driven by metal casting foundries conducting full conversions from sand to ceramic casting media in response to new OSHA silica dust permissible exposure limits for respirable crystalline silica. Converting completely from sand to ACCUCAST provided employee safety, eliminated the costly investment needed to comply with mandated OSHA regulations and produced higher-quality castings. We continued to develop new CARBOGRIND® products to provide the mining industry with a complete portfolio for fine and ultra-fine grinding applications.

EXPANDING THE ENVIRONMENTAL ARENA ASSETGUARD™, our environmental business, increased revenue by 39% in 2018 and comprised approximately 15% of total consolidated revenue. We experienced strong product sales to diverse distributors and end-users, including food and beverage, retail, medical and municipalities, while continuing to provide valuable spill prevention and containment solutions in the oilfield. GROUNDGUARD®, our impermeable liner technology that protects any industrial, agricultural or commercial site against leaks or spills of fluids, grew 69%.

MANUFACTURING FACILITIES OPTIMIZATION AND A UNIQUE OPPORTUNITY In 2018, we continued to find new opportunities to utilize our plant assets to generate cash flow. Our state-of-the-art facilities are an attractive means for third parties to add manufacturing capacity. Contract manufacturing clients include companies in the oil and gas, manufacturing, construction and agriculture industries.

We became a minority owner in PicOnyx, Inc. They have developed M-Tone ™, a new family of functional pigments for the plastics, paints, ink, coatings and adhesives markets. M-Tone will provide a superior, environmentally safe alternative to carbon black.

2017

In 2017, CARBO continued its transformation from a predominantly oil and gas services company to a company serving the oil and gas, environmental and industrial sectors. In 2017, CARBO proved that leveraging its strengths could transform its own business and its clients’ businesses. Year-over-year revenue growth of 83% provided evidence that the transformation strategy is working.

Total company revenue for 2017 increased 83% from 2016, driven by solid revenue growth in each of our businesses. Management continued to reduce costs across the organization. We trimmed our distribution footprint while retaining the flexibility to handle client needs. Through initiatives such as closing and subleasing facilities and idled rail cars, we reduced distribution expenses by $9 million on an annualized basis in 2017. We made the strategic decision to divest our Russian proppant business for $22 million. This move strengthened our liquidity position and reduced risk in our company portfolio.

In fiscal 2017, CARBO delivered strong and balanced performance, with notable improvements in all of our businesses. These were the result of strategic decisions and bold initiatives developed to reduce the company’s long-time reliance on the historically cyclical petroleum industry by channeling our defining strengths, unique skillsets and differentiating attributes to create a more diversified, capable and stable company.

For nearly four decades, the CARBO name has been synonymous with ceramic proppant. In 2014, our base ceramic proppant provided approximately 80% of the Company’s total revenue, while in 2017 it represented approximately 30% of total revenue.

In 2017, we continued to develop, introduce and commercialize technology-driven products. Through increased product sales and an expanding global client list, oilfield technology revenue increased significantly compared to the prior year. Our strategic decision to provide high-quality sand alongside our proprietary ceramic proppant continued to generate revenue growth as well. By using maximum capacity in our own facilities and through third-party arrangements, sand sales increased more than sevenfold, from 311 million pounds in 2016 to 2.19 billion pounds in 2017.

We made a transformative commitment to the industrial sector by introducing products engineered for specific industrial applications. We also added significant resources to our technical sales team. As a result of this strengthened focus, our industrial revenues increased 75% over 2016's levels. New clients accounted for roughly one-quarter of our industrial sales in 2017.

During 2017, CARBO continued our program to employ idled or under-utilized assets to generate cash flow. We leveraged the CARBO Technology Center and our state-of-the-art manufacturing facilities to provide minerals processing capacity to a number of companies in the oil and gas, manufacturing, construction and agriculture industries.

In 2017, more than 50% of environmental segment revenue came from product sales rather than services.

2016

As the year began, the entire oil and natural gas industry faced the ongoing challenges of one of the most severe cyclical downturns in history. In the face of this downturn, CARBO maintained its focus on cash preservation, cost reductions, and the development of new and differentiating technologies that provide immediate and long-term value for clients. We focused on leveraging our unique technologies and manufacturing expertise to capture opportunities in other industries to offset the severe cyclicality of the oilfield.

By mid-year, oil prices had stabilized and then slowly rebounded through the remainder of the year, signaling the beginning of an energy industry recovery. While this improved market conditions for our oilfield-related products and services, our initiatives to identify and capture new opportunities repositioned CARBO as a company with a much broader base on which to build for 2017 and beyond.

In 2016, CARBO continued to develop proprietary technologies that significantly increase value for operators.

KRYPTOSPHERE® technology produced high-strength, ultra-conductive ceramic proppant that represented a steep change from traditional ceramic proppant. KRYPTOSPHERE HD (high density) proppant, engineered for critical high- stress wells, was used by two major oil companies operating in the deepwater Gulf of Mexico where closure stress can exceed 20,000 psi.

During the year, KRYPTOSPHERE LD (low density) proppant was pumped in a high-profile well in the Utica basin of the northeastern U.S., leading to additional jobs from the same client. It has since been incorporated into a number of new completion designs in other U.S. and international basins.

QUANTUM, a breakthrough in far-field Propped Reservoir Volume™ (PRV™) imaging, provides visualization of the propped fracture for the first time. QUANTUM field trials were conducted in 2016.

CARBONRT®, an inert tracer technology, continued to expand its applications globally. CARBONRT is now available to mix with all proppant types and can be used in hydraulic fracs, gravel packs and frac-and-packs.

The GUARD™ family of proppant-delivered production assurance continued to gain wide acceptance in every type of reservoir by preventing the buildup of undesirable deposits that inhibit production. Our GUARD products can minimize or eliminate the substantial cost and time required to regularly shut wells down for workovers and traditional cleaning treatments.

Alongside the growing domestic and international success of SCALEGUARD®, field trials began for SALTGUARD™, PARAGUARD™ and H2SGUARD™. The GUARD products can be added to sand as well as ceramic proppant, opening up large markets.

FUSION®, a novel technology that creates a bonded proppant pack without closure stress and provides long- term well integrity for production and injector wells, was introduced in the Gulf of Mexico.

CARBOAIR™, an ultra-low density proppant engineered to transport deeper into the frac than sand to maximize reservoir coverage and contact, was introduced to the market during the year. CARBOAIR has a density that is 25% lower than sand.

2015

In 2015, CARBO, like the rest of the oil and natural gas industry, endured one of the worst cyclical downturns in recent history. Unlike most companies, however, CARBO was able to introduce new technologies and products that could immediately help producers reduce operating costs and increase the economic performance of wells.

Throughout 2015, CARBO pursued aggressive cash preservation and cost reduction efforts. We idled several of our proppant manufacturing facilities in order to rationalize our capacity to the demands of the industry. We worked with our supply chain to achieve lower costs and minimize capital expenditures. These and other steps reduced operational and overhead costs across the company.

At the request of a major client, CARBO engineered KRYPTOSPHERE HD, the world’s first ultra-conductive proppant, designed to provide twice the conductivity over existing proppant in the world’s deepest, highest-pressure (20,000 psi) wells. In 2015, multiple deep wells were pumped in the Lower Tertiary formation of the Gulf of Mexico using KRYPTOSPHERE HD. Since then, other clients have confirmed plans to use KRYPTOSPHERE HD in their wells.

In 2015, CARBO introduced KRYPTOSPHERE LD, a low-density proppant that provides more estimated ultimate recover (EUR) than competitors’ intermediate and low-density ceramic proppant across a broad range of conditions, with closure stress of 6,000 to 14,000 psi, due to its dramatic increase in conductivity. The first commercial job with KRYPTOSPHERE LD was pumped in late December 2015.

Also in 2015, we began developing CARBOAIRTM, an ultra-low density proppant engineered to transport deeper into the frac than sand to maximize reservoir coverage and contact.

With our full product suite of proppants — from ultra-conductive KRYPTOSPHERE HD and LD for the world’s critical wells to value-oriented products such as efficiently manufactured ECONOPROP® and HYDROPROP® and even sand—we can meet the needs of any client.

SCALEGUARD® technology continued to grow in sales volume and number of clients throughout 2015. The deep wells that used KRYPTOSPHERE HD also incorporated SCALEGUARD, which speaks highly of client confidence in the technology’s effectiveness.

Our unique GUARD production assurance technology can be applied to many industry problems. In addition to SCALEGUARD, we began tests of SALTGUARDTM to prevent salt precipitation, PARAGUARDTM to inhibit paraffin build-up and H2SGUARDTM to control hydrogen sulfide gas. GUARD products reduce operating costs, keep production flowing and increase EUR. They can be used with ceramic or sand-based proppant, thereby opening the potential market to all fracs.

In 2015, CARBO began field testing FRACTUREVISIONTM technology, a breakthrough that, for the first time, enabled an operator to see the position of the entire proppant pack in the fracture. CARBO detectable proppant, deployed as part of the regular proppant pack, can be traced to provide unprecedented accuracy for fracture evaluation. This allows an operator to optimize fracture and completion design, well spacing and field development plans.

2014

For CARBO, and the entire oil and natural gas industry, 2014 was marked by two distinct periods. During the first half of the year business conditions were favorable, and CARBO experienced encouraging results. In the second half of the year, however, global crude oil production levels resulted in an oversupply, and crude oil prices rapidly declined to reach a five-year low.

The 2014 ceramic proppant market was impacted by two main factors. A number of exploration and production (E&P) operators began experimenting with the increased use of raw sand proppant instead of ceramic proppant. With an oversupplied ceramic proppant market, cheaper Chinese products of inferior quality remained in the market. These events drove both domestic and international competitors to reduce prices. As a result of these market conditions, our ceramic proppant sales volumes and revenues declined from the previous year.

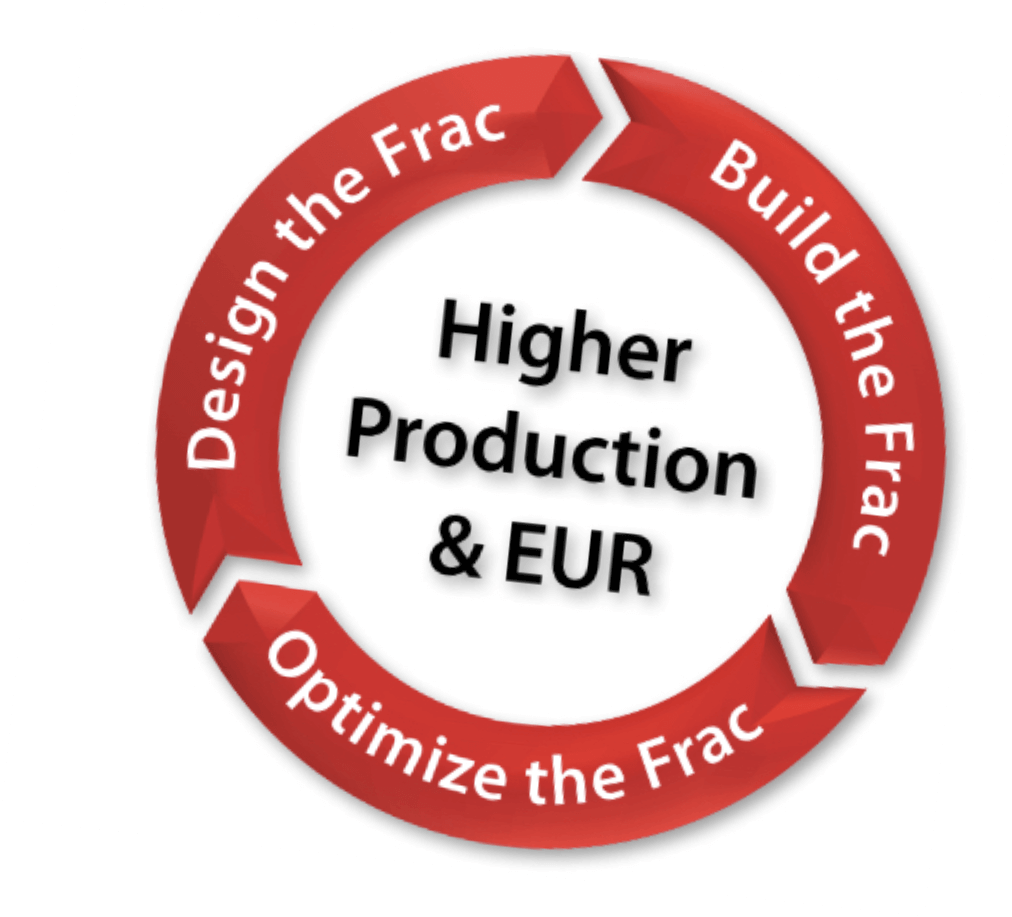

The oil and gas industry is cyclical. Our management team has experienced multiple industry downturns and understands what is required to navigate these cycles. Our priority has been managing the cash flow in each of our businesses as we also implemented measures to reduce costs. Throughout the year, we leveraged our Design, Build, and Optimize the Frac® platform to provide a holistic production enhancement solution to maximize our clients’ well production and increase estimated ultimate recovery (EUR). And, importantly, we continued to introduce significant technologies for production enhancement that differentiate CARBO from competitors in the marketplace.

Throughout 2014, in each of our businesses, we increased efforts to introduce innovative technologies, improve operating efficiencies and enhance our offerings to our clients. We combatted market conditions and cheap, low-quality competition by focusing on things for which there are no substitutes.

At the end of 2014, the first commercial KRYPTOSPHERE® HD job was successfully pumped in the Gulf of Mexico. This ultra-high-strength proppant set a new paradigm for increased production and EUR in the deepest, highest-pressure wells.

Our innovative SCALEGUARD® proppant was named as a finalist in the 2014 World Oil Awards which honor the industry’s top innovations. SCALEGUARD job intensity ramped up in 2014, with results exceeding clients’ expectations.

CARBO introduced Relative Permeability Modifier (RPM) technology that increased the effective fracture length, conductivity and permeability of the pack, leading to higher production and increased ultimate recovery. Client acceptance has been enthusiastic.

Demand for cost-neutral and production-neutral design services became so strong that STRATAGEN shifted a group of engineers solely to that purpose in late 2014.

RPM technology was introduced in the second quarter of 2014. By reducing the amount of water being trapped in the proppant pack, RPM technology increased the effective fracture length, drainage area and conductivity of fractures, thereby improving permeability to hydrocarbons.

In 2014, KRYPTOSPHERE HD production was ramped up to commercial levels, and we began retrofitting the plant to manufacture KRYPTOSPHERE LD, the new ultra-conductive, low-density ceramic proppant.

In 2014, CARBO took important steps to enhance its distribution system. We added storage at facilities around the nation. We also added three new distribution centers to better serve the Bakken, Permian and Northeast regions.

2013

2013 was a rewarding year for CARBO. We were able to generate favorable results, even though market conditions were challenging as the oil and natural gas industry remained in a downward cycle for the first half of the year. Moreover, there continued to be excess capacity of low-quality Chinese ceramic proppant in the market, causing pricing pressure. In the second half of the year revenues and ceramic proppant sales volume set new record highs for the company, driven by strong demand and market share gains. Additionally, the year was notable for important innovations and technological milestones.

In fiscal 2013, CARBO enhanced its position as the world’s largest supplier of ceramic proppant. Ceramic proppant volumes in 2013 set a record, topping 1.7 billion pounds, an increase of 4% despite a market that was over-supplied with low-quality Chinese ceramic proppants.

In our ceramic proppant business, we created three technology platforms upon which to build distinct product lines: 1) Production assurance, 2) Flow enhancement 3) Production intelligence. We structured the company organization to develop these technology platforms, and we expanded our technical workforce to establish a framework for the growth we expect as we expand in each area.

In 2013, CARBO introduced KRYPTOSPHERE, a technological step-change in the way proppant is engineered and manufactured. The revolutionary, precision-engineered microstructure of KRYPTOSPHERE translates into a stronger, more spherical and mono-size proppant that creates more space in the fracture for hydrocarbon flow. We are currently scaling up manufacturing capabilities to allow commercialization of this breakthrough proppant technology. The first product introduced, KRYPTOSPHERE-H, is an ultra-conductive, high strength proppant that delivers more than twice the baseline conductivity of bauxite-based, high-strength proppants in deep, high-stress wells.

In 2013, SCALEGUARD was commercialized. From the time the proppant is pumped into a well, SCALEGUARD begins providing an effective method to inhibit scale deposits that frequently build up in the well bore and other tubing to impede or completely block the passage of hydrocarbons.

We are committed to leadership in Production Enhancement technology. Our Design, Build, and Optimize the Frac™ platform provides a complete solution to maximize our clients’ well production and increase estimated ultimate recovery (EUR). Using this approach, we were able to address each client’s specific needs, whether it was creating a comprehensive fracture solution or simply providing a single component of our Design, Build, and Optimize the Frac platform.

In 2013, we expanded our technical marketing campaign to emphasize the synergistic design value in Fracpro, the industry’s most widely utilized fracture simulation software, the build value in CARBO Ceramics proppant products that provide space to flow for oil and natural gas in the frac and the optimize value in StrataGen, our highly specialized completions and reservoir consultants.

Manufacturing capacity increased with the addition of our new manufacturing plant in Millen, Georgia. Construction remained on scheduleahead of the planned completion of Line 1 in mid-2014. Once completed, Millen Line 1 took our annual ceramic proppant capacity from 1.75 billion pounds to 2 billion pounds. Additionally, construction commenced during the first half of 2014 on Millen Line 2, which also has an annual capacity of 250 million pounds.

Fracpro generated record sales in 2013, and grew its client base globally.

In 2013, we observed a shift in many operators’ focus, from completing wells primarily for lease-holding purposes to using completion and frac techniques that increase well and project value. This shift in focus created tremendous opportunities for StrataGen.

2012

In a year marked by a dramatically shifting marketplace and increased competition, CARBO achieved record revenues and generated positive results for shareholders. We faced challenges as the supply and demand dynamics of the industry were rebalancing. As we have done through more than 30 years of industry leadership, CARBO focused on managing the business through these swings in activity while positioning the company for long-term success.

CARBO’s worldwide proppant sales volume totaled 1.71 billion pounds in 2012, an increase of 7% compared to 2011.

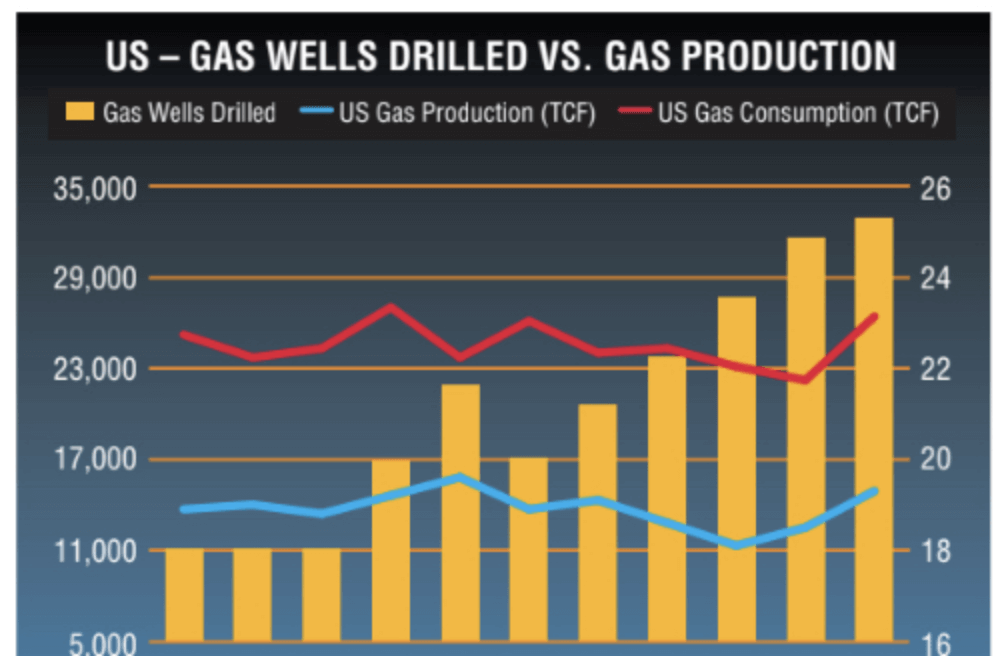

In 2012, the industry’s overall drilling activity declined in North America as lower natural gas prices continued to shift activity away from natural gas and toward liquids-rich plays. Wells in these liquid plays realize significant benefits from the increased conductivity provided by the high-quality ceramic proppant that makes up the majority of our business.

We continued to differentiate our products and our company with our technical marketing campaign that communicated the advantages and benefits of Economic Conductivity®. CARBO engineers performed an Economic Conductivity analysis to determine a well’s production for various amounts invested in proppant and stimulation treatments. The result is designed to optimize economic performance and return on investment.

We continued our investment in the development of new products, and each of our businesses—proppant, Fracpro, StrataGen and Falcon — introduced or successfully commercialized market-driven products in 2012.

CARBO identified a new technique for the production of ceramic proppant that would redefine the boundaries of performance. Using this new technique, we were able to produce a ceramic proppant with increased strength and conductivity compared to traditional ceramic proppants. We then scaled production up to commercial quantities and preparing for a product introduction.

One of the primary challenges we faced during 2012 was the industry’s relocation of equipment, services and supplies into the liquids-rich basins in North America. While CARBO sales volumes were healthy in the Bakken and Eagle Ford formations, infrastructure to support industry activity remained limited. As a result, associated logistics costs increased.

CARBO made strategic investments in facilities that enable us to more efficiently serve clients in these areas. To serve the Eagle Ford we expanded our distribution center in South Texas, and in the Bakken we added two transloading facilities with plans to build a large distribution center.

In 2012, the proppant industry experienced a significant over-supply of Chinese ceramic proppant. Although this proppant varied greatly in quality, the over-supply placed substantial pricing pressure on the entire proppant industry.

Our strategy to educate the industry of the risks to well production when using a low-quality Chinese ceramic proppant was straightforward. We demonstrated that CARBO ceramic proppant is measurably superior in terms of product quality and in the performance it produces in our clients’ wells. Additionally, our lightweight ceramic product lines offer a volume advantage compared to the intermediate density products offered by competitors, meaning that our proppant will provide greater fracture volume and conductivity per pound—in most cases approximately 20% greater effective frac width and length. CARBO also provides a high level of customer service, adding important value to our products. We saw that many E&P companies turned away from the inferior products as their inventories are consumed.

2011

Our worldwide proppant sales volume totaled a record 1.6 billion pounds in 2011, an increase of 19% compared to 2010. The increased volume was due to strong client demand and the increased production capacity provided by the addition of the third line at our Toomsboro, Georgia, manufacturing facility.

As the industry continued its shift from natural gas plays to liquids-rich plays, conductivity became even more important, driving demand for CARBO’s high-conductivity ceramic proppants.

To allow us to further benefit from periods of strong market demand, in late 2011 we completed construction of the fourth line at Toomsboro, adding an incremental 250 million pounds of manufacturing capacity. At year-end our ceramic proppant stated manufacturing capacity was approximately 1.7 billion pounds annually.

CARBOBOND® RCS marked CARBO’s entrance into the resin-coated sand (RCS) proppant market, generating a positive response from our clients. By introducing CARBOBOND RCS, CARBO has added another complementary business. It allows us to leverage our distribution network, our manufacturing expertise and our client-service reputation. For our clients, CARBOBOND RCS allows us to broaden our product offering range into more wells, broaden our E&P client contact to capture more of their spend, and broaden our product price points.

In response to market demand, in early 2012 we added resin-coating production capacity for our CARBOBOND RCS proppant with a second line at our New Iberia, Louisiana, plant capable of providing an additional 300 million pounds per year.

The industry’s most widely used fracture design modeling software had a record year, growing its client base around the world. Fracpro XCHANGE, designed for onsite use with frac van displays, accounted for much of the product line growth.

One of the most exciting developments of 2011 was Fracpro 3D, the most flexible and sophisticated 3D fracture software program in the industry at the time. Fracpro 3D was designed to provide a new standard of analysis and accuracy.

The fourth manufacturing line at our Toomsboro, Georgia, facility commenced operation in September. The addition of this line increased CARBO’s total ceramic proppant capacity to approximately 1.7 billion pounds per year. Plans for the future expansion of our ceramic production capacity are underway at our future plant site in Millen, Georgia. This site was targeted for an initial manufacturing capacity of up to 500 million pounds annually.

Our resin-coated sand (RCS) proppant facility in New Iberia, Louisiana, began operating its second production line in late January 2012. With the second line operating at full capacity, this facility will be able to produce up to 400 million pounds of CARBOBOND annually. Additional RCS capacity was provided by our new plant in Marshfield, Wisconsin, with a designed initial capacity of 600 million pounds annually. Our total RCS capacity was estimated to be approximately 1 billion pounds annually upon completion.

While North American market activity dominated our operations in 2011, CARBO continued to strategically develop its presence in international markets.

2010

CARBO achieved record financial and operating results in 2010.

As the oil and natural gas industry began to rebound from some of the worst economic conditions in memory, the dedication and expertise of our people helped propel the company to an outstanding performance.

During 2010, we saw market fundamentals drive a shift in drilling activity from natural gas to oil. In oil reservoirs, the enhanced conductivity provided by ceramic proppant is even more critical to success.

CARBO Ceramics brought innovative new products to market in 2010. CARBOBOND® is a resin-coated proppant designed to minimize flowback in a well. CARBOBOND opened a new revenue stream for CARBO Ceramics. Previously, third parties purchased our ceramic proppant, coated it and resold it. With CARBOBOND, we were be able to maintain our high standards of quality and service while realizing a financial benefit from directly offering our customers a premium resin-coated product.

We also made the strategic decision to enter the resin-coated sand market, allowing us to serve a broader spectrum of our clients’ proppant requests. The introduction of CARBOBOND RCS garnered immediate interest from many of our clients. Ultimately, we envisioned CARBO playing a significant role in the resin-coated sand proppant market as we executed our growth plans during the next several years.

CARBO Ceramics also expanded our iProp family of detectable proppants with the introduction of CARBONRT non-radioactive traceable proppant. This technological breakthrough does not have the same environmental or safety risks associated with competing radioactive products. CARBONRT helps the industry demonstrate its increasing focus on environmental and safety responsibilities.

Fracpro remained the industry standard for fracture simulation software. In 2010, we acquired ownership of the source code underlying FracproPT, providing our engineers and developers flexibility to advance the capabilities of the software while maintaining its proprietary nature. We expanded its functionality in horizontal reservoirs and shale plays, where most new onshore drilling activity was taking place. Oil and gas companies, service companies and leading universities continued to adopt Fracpro during the year, and we deepened our technology partnership with clients by offering training programs around the world.

StrataGen Engineering, our independent consulting arm, earned a reputation as one of the industry’s foremost firms in unconventional reservoirs. During 2010, StrataGen continued to develop sophisticated workflow and data mining processes while also increasing the number of consultants providing field service to customers on location. We also launched an annual technology exchange day with clients.

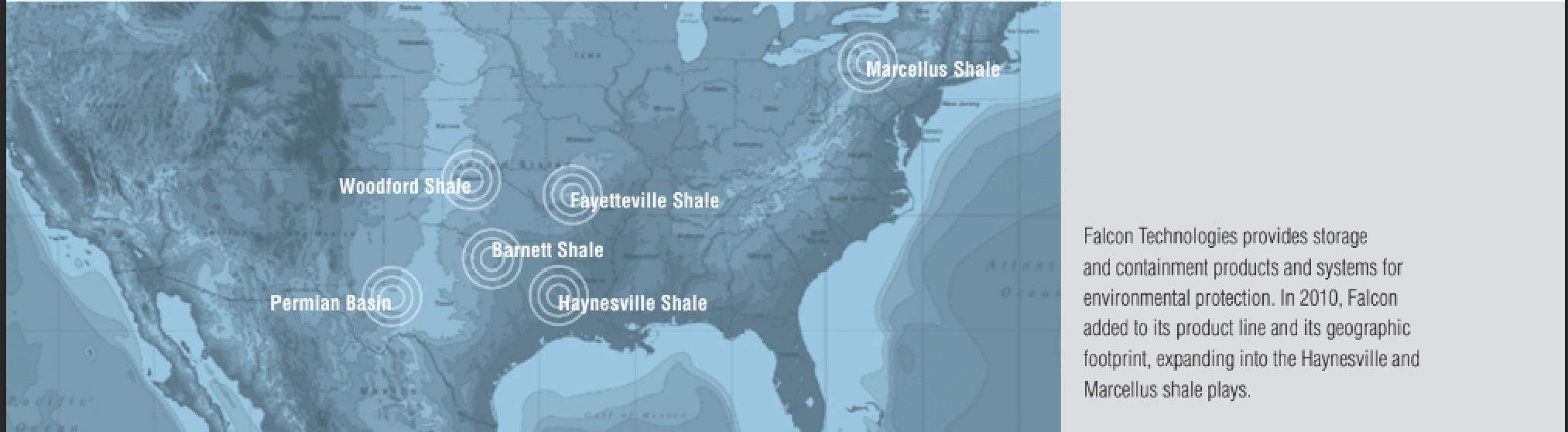

Falcon Technologies, acquired in October of 2009, is a leading supplier of spill prevention and containment systems. The growing environmental awareness and stewardship across the oil and gas industry provided an economic tailwind for Falcon. We set Falcon up to grow through new product development, geographic expansion and product line extension. Notably, in 2010, Falcon introduced significant advances in surface-mounted containment technology and expanded its business into unconventional resource areas in the U.S. while gaining financial strength.

Applied Geomechanics (AGI) helps customers reduce the risk of loss by providing geophysical monitoring solutions for buildings, infrastructure and topographical features. Projects in 2010 included major infrastructure construction in the New Orleans area, notably the Huey P. Long Bridge over the Mississippi River.

One of our most visible achievements in 2010 was the opening of our new Houston Technology Center. This state-of-the-art facility centralized our R&D efforts and supported CARBO’s future growth by reducing the time from concept to commercialization of new products. The Technology Center also provided a showcase to better present our technology and products to clients, enhancing our visibility and our reputation for technological leadership within the industry.

2009

As 2009 began with deteriorating economic conditions, CARBO’s management team made disciplined decisions to reduce costs, but not negatively impact our long-term investment for growth. We relocated our corporate headquarters to Houston, resulting in improvements in communication, focus and teamwork.

CARBO Ceramics continued to see tremendous success with its lightweight ceramic proppant, CARBOHYDROPROP®, a product conceived and developed specifically for the “slickwater” fracturing technique frequently used in tight gas shale formations. Many of these emerging, large resource plays continued to see drilling activity much stronger than the rest of the industry. We took advantage of this opportunity and expanded the distribution of CARBOHYDROPROP into the strongest plays throughout the U.S. and Canada, including the Eagle Ford and Marcellus. It is a tribute to our manufacturing and distribution operations that we were able to quickly and efficiently ramp up the production of CARBOHYDROPROP, allowing CARBO to benefit from this activity. Our research and development group continued to develop innovative, market-driven products. We introduced CARBOBOND™, a resin-coated proppant line designed to minimize flowback in a well. Our commitment to investing in proppant manufacturing capacity remains unchanged, and we anticipated completion of the third production line at our Toomsboro, Georgia, plant near the end of 2010. This increased our total manufacturing capacity by nearly 20%, enabling us to better meet customer demand for our high-conductivity ceramic proppant.

FracproPT, the industry’s most popular fracture simulation software, was enhanced with richer functionality, improved accessibility to customer service and support, and more foreign language offerings, further securing its status as the industry standard.

StrataGen Engineering broadened its core stimulation consulting business to include benchmarking studies, gathering comprehensive data from producers throughout a given reservoir to help operators optimize their entire completion process and rate their success from year to year.

Falcon Technologies became part of CARBO in October 2009 when its wholly owned subsidiary purchased the assets of BBL Falcon Industries, Ltd. Falcon is a leading supplier of spill prevention, containment and countermeasures (SPCC) systems for oil and gas operators. We believe that Falcon’s proprietary technology and value-added solutions would be increasingly important as the oil and gas industry sharpens its focus on environmental issues and compliance with SPCC regulations.

Applied Geomechanics (AGI) continued its transition from being primarily a product supplier to being a technology solutions partner to its customers. The company was awarded several high-profile jobs in 2009. AGI provided a system to monitor the world’s largest active landslide, covering 260 acres at the Trapper coal mine in Colorado. The system can detect movement as slight as one millimeter. AGI conducted infrastructure monitoring at several airports for the Federal Aviation Administration, and also provided equipment for NASA, the U.S. Geological Survey and other scientific institutions.

2008

In 2008, CARBO began marketing CARBOHYDROPROP, a new lightweight ceramic proppant developed specifically for the slickwater fracture market. Certain reservoirs require a low viscosity fluid (“slickwater”) and a lightweight proppant in order to transport the proppant the required distances out into the fractures. CARBO’s innovative technical marketing initiative resulted in a proppant that has more than 40 percent higher conductivity than resin coated sand.

It also has better transport characteristics, yet has a selling price similar to resin coated sand. Operators looking to maximize their return on investment quickly began using CARBOHYDROPROP, and customer demand outpaced our supply. CARBO’s proppant plants operated at or near full capacity from the second quarter through the end of 2008.

CARBO Ceramics is the world’s largest supplier of ceramic proppant. In 2008, we generated record proppant sales of more than 1.1 billion pounds.

CARBOHYDROPROP was the company’s most successful new product launch ever and demonstrated the ability of our research and development, manufacturing, and marketing teams to rapidly develop a product targeted at a specific new market. To meet increasing customer demand for CARBOHYDROPROPTM and our other high-quality ceramic proppants, we announced the construction of a third production line at our state-of-the-art Toomsboro, Georgia, plant which expanded our total manufacturing capacity by nearly 20% to 1.5 billion pounds.

FracproPT, our hydraulic fracture design software, became the market leader. In 2008, we added new functionality and specialized versions of the software, including Russian and Chinese translations. FracproPT’s professional user base continued to grow globally, and the software was incorporated into the petroleum engineering programs at seven additional universities worldwide, helping assure its future standing in the industry.

In 2008, CARBO’s engineers added a logical and practical measure called Economic Conductivity. This approach proved successful with operators in the most important oil and natural gas fields across North America, including the Bakken Shale in Montana, North Dakota, and Canada; the Haynesville formation in east Texas and Louisiana; the Deep Barnett in west Texas; and numerous others. The benefits of increased conductivity were documented in more than 80 technical papers authored by CARBO engineers and published by the Society of Petroleum Engineers, representing our work with more than 70 different companies.

2007

Among our most significant accomplishments in 2007 were: • The completion of two new proppant manufacturing facilities, financed entirely from internally generated funds.

- • The completion of two new proppant manufacturing facilities, financed entirely from internally generated funds.

- • The introduction of CARBOHYDROPROP, a new lightweight ceramic proppant for use in the growing market for “slickwater” fracturing treatments.

- • Record revenue from overseas markets.

- • The addition of senior marketing people with broad international experience.

- • The initiation of ceramic proppant field trials in new reservoirs where fracture diagnostic technology identified opportunities for oil and gas operators to benefit from the increased conductivity generated by ceramic proppant.

2007 also included excellent revenue growth led by Pinnacle Technologies’ tremendous results. Pinnacle’s revenue increased 45% and its operating income increased by 67% over the previous year. In our proppant segment, we produced and sold record volumes of ceramic proppant, and revenues increased 5% despite a difficult operating environment in a number of our key North American markets.

In 2007, we completed and began operating our Russian proppant manufacturing plant. Constructing this world-class plant was a major challenge, ably met by the dedicated people at CARBO. We also completed the construction of a second production line at our state-of-the-art manufacturing facility in Toomsboro, Georgia.

Pinnacle Technologies was actively expanding our service offerings, accomplishing many firsts during 2007. Pinnacle successfully installed our first permanent fiber optic distributed temperature sensing system, installed the first commercial tiltmeter array to perform long-term monitoring on a steam-assisted gravity drainage (SAGD) project, and released FracproPTTM 2007, the latest version of the industry-leading hydraulic fracturing software model. In our long-term monitoring business, we installed several permanent microseismic arrays and installed tiltmeters on two new pilot CO2 sequestration projects.

In 2007, CARBO developed CARBOHYDROPROP. This innovative lightweight ceramic proppant was designed specifically for the slickwater fracturing market, where an emphasis on low cost has traditionally resulted in the use of sand-based proppants. CARBOHYDROPROP is priced competitively with these alternative proppants, yet with higher conductivity (a measure of proppant performance based on permeability and fracture dimension), it was easier to place within the fracture, and is less degraded by downhole temperature and pressure.

Another proppant innovation was CARBOTAG for use in wells with multiple fractures at various depths or multiple slurry stages in a single fracture. CARBOTAG used inert chemical markers (“tags”) to help operators of wells determine important information about specific fracture treatments.

In other 2007 field trials, CARBO Ceramics participated in a trial sponsored by Petróleos Mexicanos (PEMEX) comparing the performance of CARBOLITE® to sand and resin-coated sand in Mexico. In the Velero Field, the production rates sustained after fracturing with CARBOLITE® nearly doubled versus the productivity of wells stimulated with sand.

In separate trials, CARBOECONOPROP® lightweight ceramic proppant greatly increased production rates while replacing sand and resin-coated sand in fracture treatments in the Cotton Valley formation in East Texas, as well as in the Canyon Sand shallow gas field in West Texas.

2006

We introduced CARBOTAG tagged proppant, designed to help operators effectively identify the source of proppant flowback in wells with multiple completions.

CARBO developed unique chemical markers, or TAGs, that could be incorporated into any of our ceramic proppants without altering the proppant characteristics or performance in any way. The TAG was non-radioactive and chemically inert, and it would not decay or lose effectiveness over time.

Pinnacle Technologies performed its first-ever microseismic mapping service in an active wellbore, using an array of microseismic instruments deployed in a well in which a fracture was being performed; completed a fracture mapping project in Canada using the largest microseismic array ever deployed for hydraulic fracture mapping; and initiated the first long-term reservoir monitoring project using our new Generation III Slimhole Tiltmeter.

CARBO’s record performance in 2006 demonstrated and further strengthened our leadership position in ceramic proppant, fracture diagnostic technology and fracture simulation software.

Early in 2006, our Toomsboro, Georgia, plant was completed and quickly provided the capacity needed to continue our growth. Completion of our plant in Kopeysk, Russia, was expected in early 2007 to provide a better opportunity for us to access that expanding market.

Based on record sales in 2006, the anticipated strength of the North American market, and the growing potential of overseas markets, our Board of Directors approved the construction of a second production line at the Toomsboro plant, with scheduled completion by the end of 2007.

2006 was a year of innovation for Pinnacle’s fracture diagnostic technologies. We enhanced the capabilities of our microseismic processing software, while streamlining the process to generate faster results for our customers. We deployed microseismic mapping arrays, via a tractor system, into horizontal offset wells — a development that continued the rapid growth of fracture mapping in the Barnett Shale, one of the most active natural gas plays in the U.S., where 80% of the wells being drilled at the time were horizontal.

In 2006, international operations were a significant part of our growth. International fracturing activity continued to increase, and these fracture treatments were more complex and expensive than those in North America. Russia and China were very active areas for fracture stimulation, and had growing user-bases for FracproPT and Pinnacle’s consulting services.

2005

For the third consecutive year, CARBO Ceramics achieved record levels of sales volume, revenue and net income. Despite being limited by our production capacity in 2005, we sold 772 million pounds of proppant and industrial products, a 6% increase over the 726 million pounds sold in 2004.

The CARBO team operated all of our manufacturing facilities at full capacity, doing an outstanding job of adding incremental volume beyond stated manufacturing capacities while continuing our outstanding record of quality and safety.

The strong performance of our company in 2005 was the result of continuing to follow a sound strategy for growth built upon three major components.

The use of our ceramic proppants created value for the owners of oil and natural gas reserves. Our technical marketing program continued to demonstrate that ceramic proppants yield greater productivity under a variety of well conditions than sand-based proppants. Oil and gas operators had a strong incentive to improve operating efficiency by increasing production rates from wells and more fully draining reservoirs of valuable oil and gas.

Capitalizing on technology Pinnacle Technologies was the undisputed leader in providing fracture mapping services and software products that helped producers engineer the most effective hydraulic fractures and monitor the ongoing flow of oil and gas within reservoirs. These technologies were valuable tools for the optimization of well production.

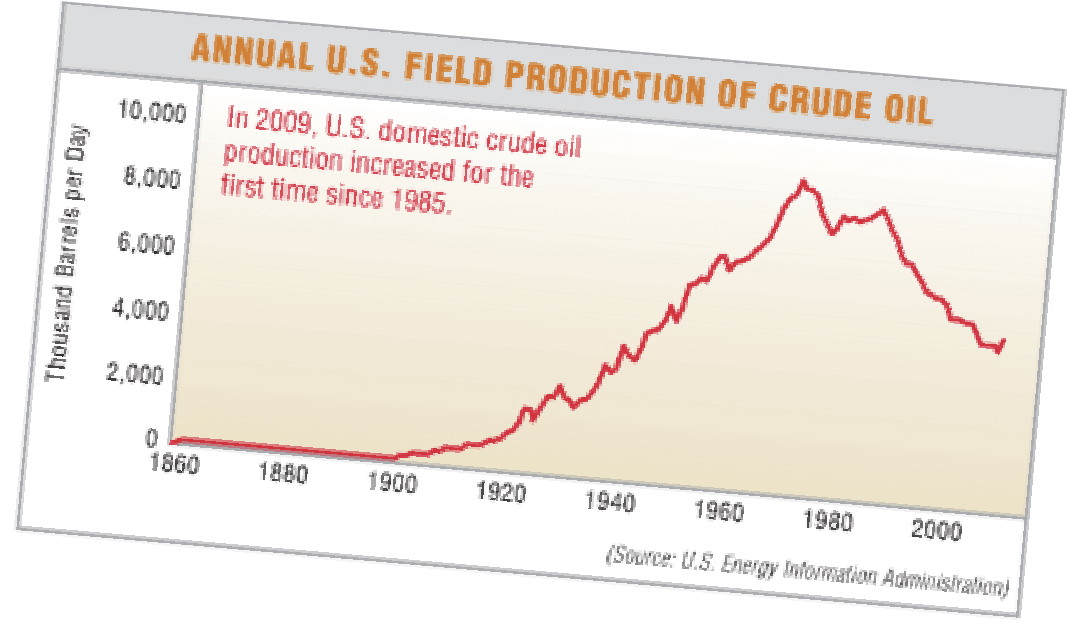

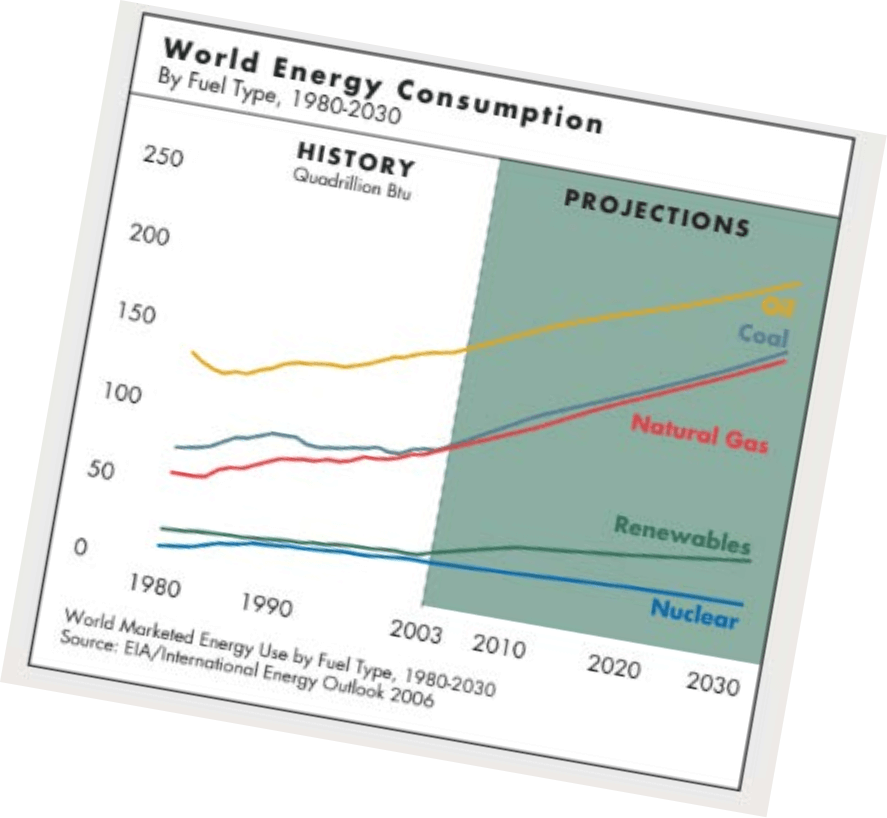

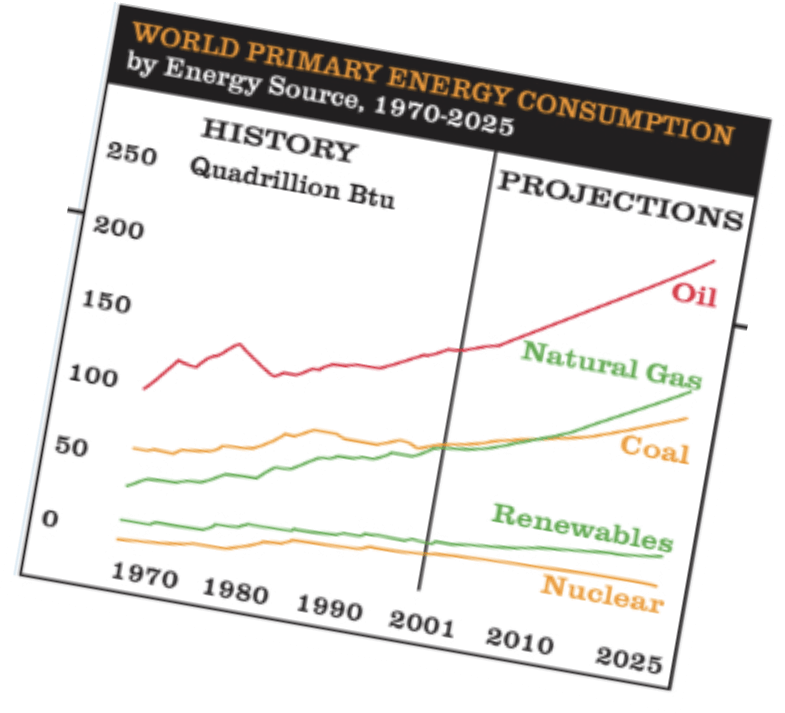

The Energy Information Administration (EIA) projected that consumption of oil and natural gas in the U.S. and worldwide markets would continue to increase over the next 20 years. To meet this demand, oil and gas producers continued to increase their drilling and production efforts. As producers around the world drilled more wells in increasingly complex formations, they required CARBO’s high-quality products and services.

Construction of our new plant in Toomsboro, Georgia, began in 2004 and was completed in early 2006, on schedule and below budget. This facility has an initial design capacity of 250 million pounds per year, representing the largest single incremental increase in company history.

In June 2005, CARBO broke ground for the construction of a new manufacturing facility in the city of Kopeysk, Chelyabinsk Oblast, of the Russian Federation. With completion expected by the end of 2006, this facility had an initial production capacity of 100 million pounds per year.

CARBO has been at the forefront of opening the Russian market for worldwide benefit, with a sales office in Moscow, a stocking location in Surgut and our new manufacturing plant under construction in Kopeysk.

Our manufacturing plant in Luoyang operated at a world-class level, with production that served the Russian and Southeast Asian markets, and positioned CARBO advantageously as the Chinese economy grew.

2004

In 2004, CARBO achieved new records in terms of product volume sold, revenue, and net income.

In 2004, our sales team sold an unprecedented 726 million pounds of proppant and industrial products, a 26% increase over the 578 million pounds sold in 2003. Our manufacturing facilities supported their efforts by producing a record 715 million pounds of product.

International markets continued to increase in importance as we grew globally. International sales accounted for 47% of revenue in 2004, with the emerging Russian market playing a particularly significant role.

In January 2004, CARBO Ceramics’ Board of Directors approved the construction of a new plant to be located in Wilkinson County, Georgia. This location complemented our existing facility in McIntyre, Georgia, and would take advantage of the significant raw material deposits we have acquired in this area. The new plant was designed to have an initial capacity of 250 million pounds per year, giving CARBO a total manufacturing capacity of over one billion pounds annually upon its projected completion at the end of 2004. This strategic expansion was vital for satisfying increasing demand across our product lines, specifically.

In China, CARBO demonstrated the ability to translate our standards of customer service, manufacturing capability, and operational quality into new environments. Our facility in Luoyang completed construction of a second production line in June 2004. The new line was operating at 95% of design capacity within months of completion. The Luoyang facility provided the ability to address the significant long-term opportunity in the domestic Chinese market, and it was also positioned advantageously to export proppant into the burgeoning Russian market.

In January 2004, CARBO established a sales office in Moscow and, by the end of the year, we opened a warehouse stocking location in Tyumen, located in western Siberia. Russia had increased its oil production in five years from six million barrels per day to nine million barrels per day. Much of this increase could be attributed to hydraulic fracturing stimulation and the implementation of improved oilfield technologies including the use of ceramic proppants.

In 2004, we added precision Global Positioning System (GPS) and satellite radar reflection technologies (InSAR) to complement our tiltmeter and microseismic reservoir monitoring technologies.

Our business has grew rapidly and our 2004 customer count more than doubled from what it was three years prior.

In 2004, we mapped our first fractures in China.

2003

An increase in global drilling and fracturing activity, and the continued momentum of our technical sales effort resulted in record sales volume for the company in 2003. The 578 million pounds of product we sold in 2003 represented an increase of 32% from the previous year and beat our previous annual record by 14%. Sales increased worldwide with North American volumes increasing 21% and overseas shipments doubling from the previous year.

International sales accounted for 35% of the company’s overall revenue stream in 2003, a figure which the Aberdeen-based Johnson attributed in part to CARBO’s reputation as “far and away the highest technical company in the business.” He added that, “Other companies treat it more as a commodity market. We make it more of a technical specialty.”

We registered CARBO Ceramics Eurasia LLC with the Russian government, established a sales office in Moscow and began exploring the feasibility of constructing distribution and manufacturing facilities in Russia.

As an opening act, CARBO and Pinnacle Technologies successfully penetrated the emerging Russian market and pooled their resources in the hiring of Vladimir Paderin as joint business development manager in Russia to help further the cause. The companies combined their forces to realize synergies in China, as well.

“We may provide different products and services, but we both have something that adds a lot of value for our customers,” Wright saidd of the union. “In addition, our ultimate challenge in the marketplace is the same. And that’s getting people to understand what’s really happening and getting them to act on that information.”

Our ongoing field trials with major natural gas producers helped boost our sales in Canada, the Rocky Mountains and East Texas, with total 2003 North American sales volume increasing 21 percent over 2002. Our ceramic proppant was used by 19 of the top 20 natural gas producers in the U.S.

We continued to expand our sales and distribution efforts overseas, where our sales volume increased 100% in 2003. Russia, the North Sea, Western Europe and the Middle East were all significant areas of sales activity. Sales in Russia and Southeast Asia were largely supported by product shipped from our manufacturing facility in Luoyang, China. In January, we opened sales and service offices in Yekaterinburg and Moscow to better position ourselves to serve the growing Russian market.

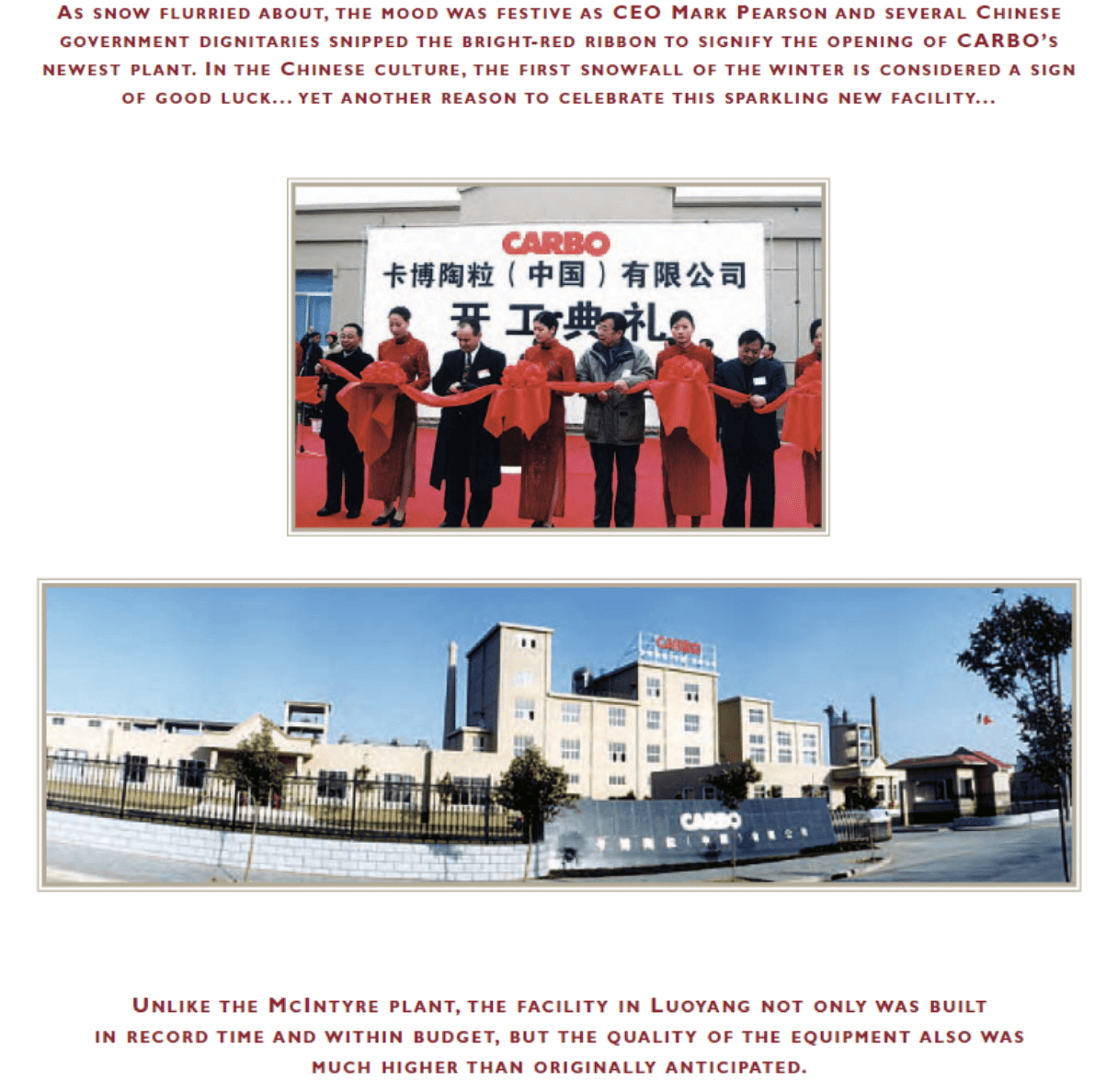

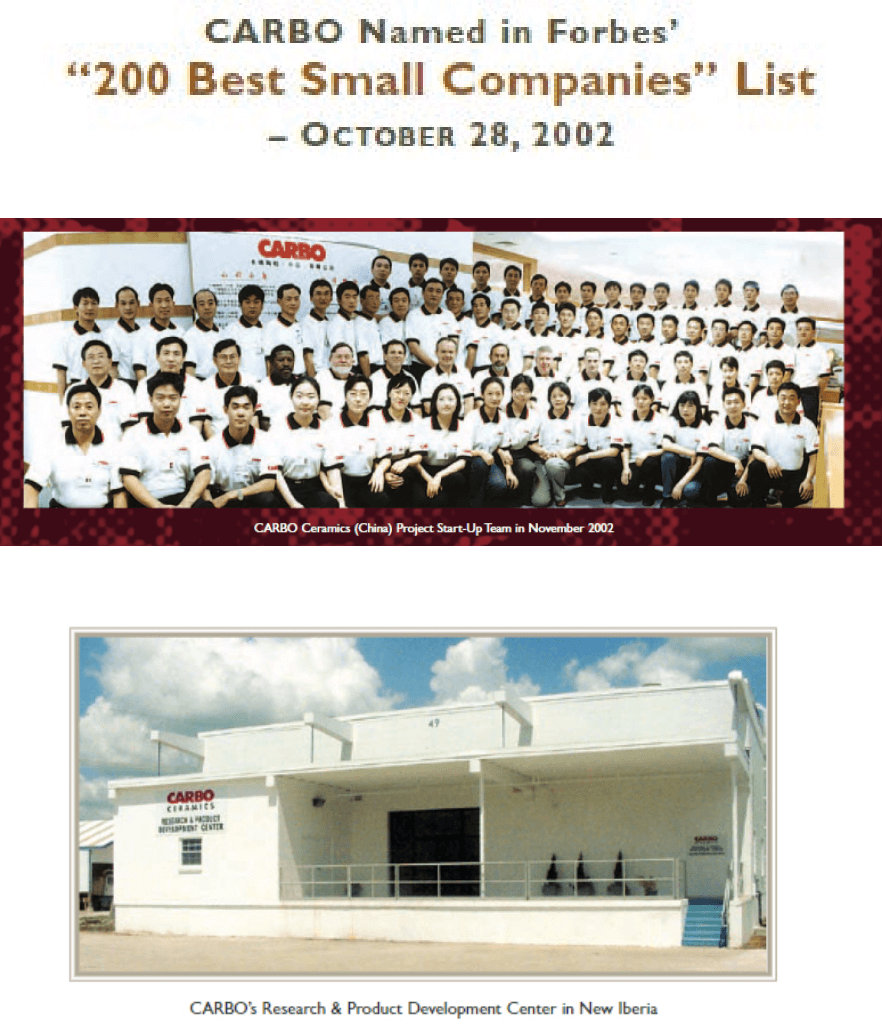

Our new manufacturing facility in Luoyang, China, which was completed in late 2002 and began shipping product in January. Within six months of its opening, the plant was running at 100% of its design capacity. The ability of this facility to efficiently produce and distribute quality products was a critical factor contributing to our sales growth in the European and Asian markets. Based on the success of our initial investment in China, our Board of Directors approved, in July 2003, the construction of a second production line. This production line was expected to be complete by mid-2004, and would double our capacity in China to 90 million pounds per year.

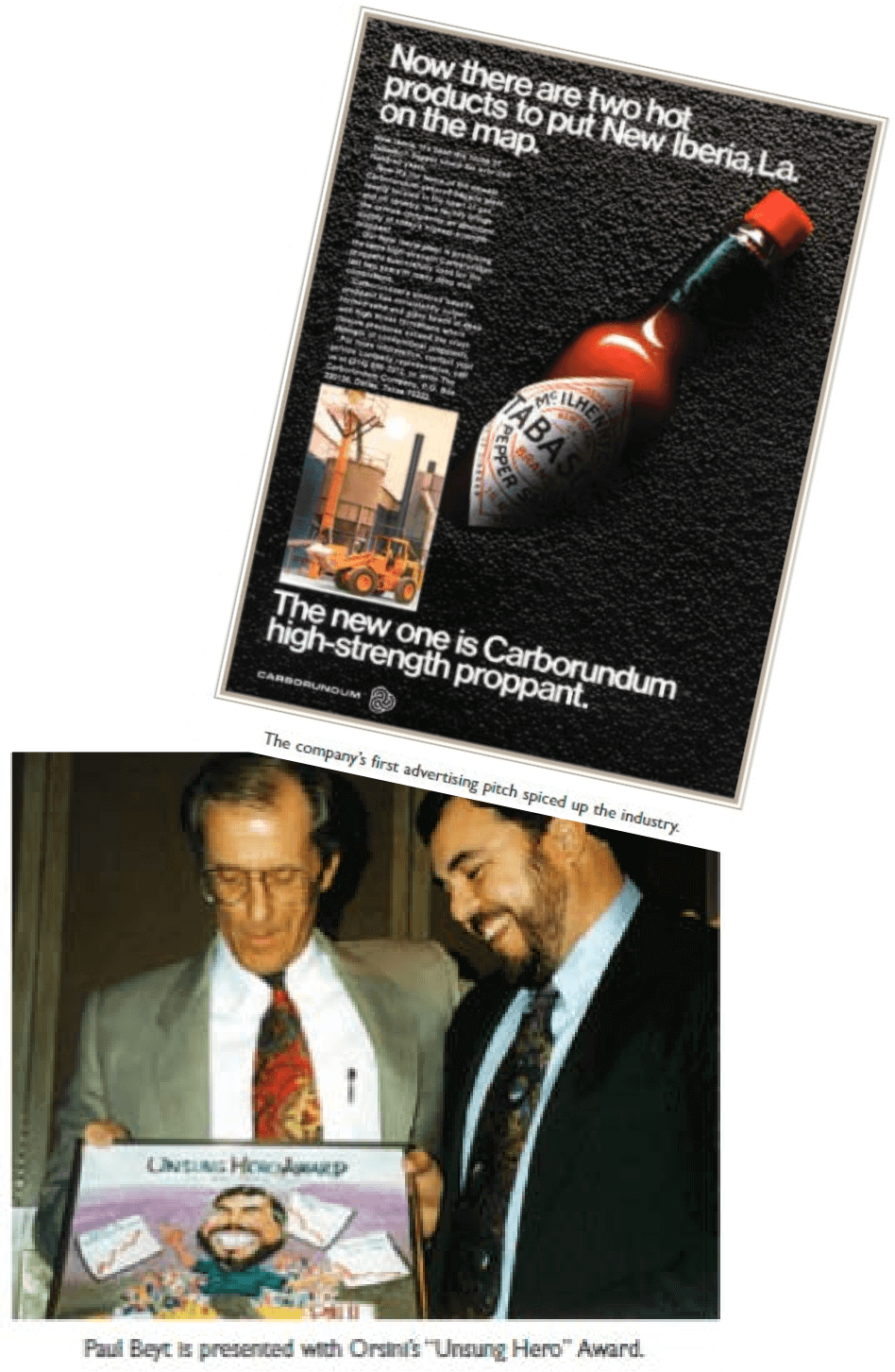

Domestically, we also realized benefits from the addition of 75 million pounds of capacity through the optimization of our McIntyre, Georgia, plant and another 20 million pounds from the addition of a third kiln to our New Iberia, Louisiana, plant.

Our Board of Directors approved the construction of a $62 million manufacturing facility in Wilkinson County, Georgia. This facility was designed to have 250 million pounds of annual production capacity initially and can be easily expanded as demand warrants. The facility was strategically located adjacent to the significant raw material reserves we have acquired in the region and it was expected to be operational by the end of 2005.

Our microseismic mapping business grew more than 200% from the previous year, driven by enhanced data processing and field operations that allowed more accurate results, quicker turnaround, and application in a wider range of mapping environments than previously possible. Additionally, the company’s surface tilt mapping service was performed on fractures deeper than 16,000 feet, expanding the range of application for Pinnacle services to include most onshore wells.

The challenges and setbacks experienced in building and starting up the McIntyre plant drove the realization that better engineering and project execution must be arranged for CARBO’s larger investments. CARBO entered into an alliance with BE&K Engineering based in Birmingham, Alabama, to fulfill these goals. BE&K effectively improved production and reliability at the McIntyre plant in 2003-04. BE&K also was instrumental in the development of the designs for CARBO’s continued expansion in middle Georgia.

2002

We made the first acquisition in our history with the addition of Pinnacle Technologies. We opened our first manufacturing plant outside North America, in Luoyang, China. We invested $20 million in capacity expansions at our manufacturing plants in McIntyre, Georgia and New Iberia, Louisiana. We built and staffed a new facility dedicated exclusively to research and product development.

2002 was not the best year for the oil and gas industry. The average natural gas rig count dropped 26% in the U.S., and the average rig count in Canada declined 24% compared to 2001. Despite these declines, our sales volume in the same period fell by only 17% in the U.S. and increased by 14% in Canada, establishing a new record for sales in that country.

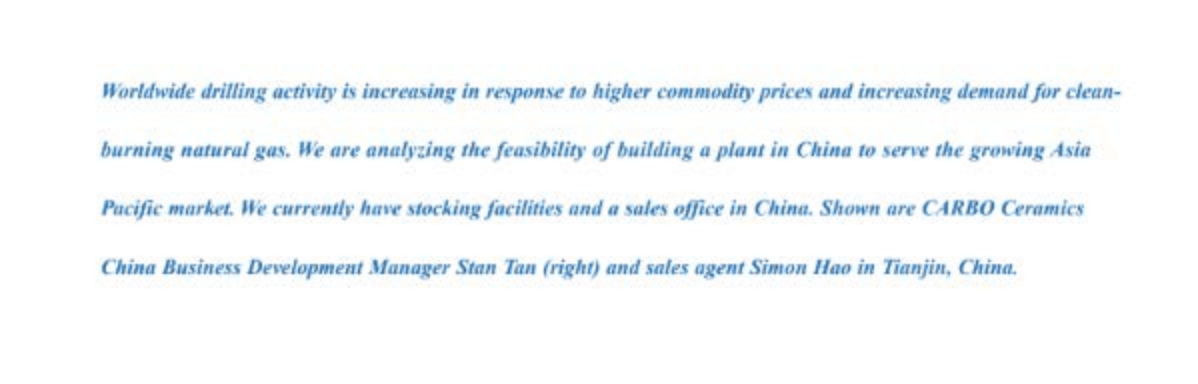

An improvement in drilling activity was expected during 2003 as the increasing global demand for natural gas spurs renewed drilling. This upturn, of course, presented ab opportunity for increased sales of our products in 2003 and beyond. True to our strategy, we have our time during 2002 building production capacity in anticipation of the recovery.

“The more that producers of oil and gas understand about the process of hydraulic fracturing, the more willing they are to invest in high-quality ceramic proppant to maximize production,” said Chris Wright, President, Pinnacle Technologies, Vice President, CARBO Ceramics.

CARBO Ceramics acquired privately held Pinnacle Technologies, the largest provider of fracture diagnostic services to oil and gas companies worldwide. Pinnacle provides fracture mapping services that monitor hydraulic fractures, and its fracture simulation model, FracproPT, was the most widely used in the world.

“Some may ask why we continue to build manufacturing capacity when the market is down. The answer is that we are planning for the long-term continued success of our company. Rather than allowing the industry or the economy to dictate what we can be, we are defining our own destiny,” said C. Mark Pearson, President and CEO.

We increased our production capacity by 25% with the addition of a new ceramic proppant manufacturing plant in China and expansions at our Georgia and Louisiana facilities.

During the year, we also expanded our manufacturing facilities in McIntyre, Georgia and New Iberia, Louisiana. In Georgia, we made improvements in throughput to expand the annual capacity by 75 million pounds, an increase of more than 35% over the previous capacity. By adding a third kiln at our Louisiana plant, we added 20 million pounds of annual production capacity. With these two expansion projects, the new facility in China and our manufacturing plant in Eufaula, Alabama, CARBO Ceramics had installed annual production capacity of nearly 685 million pounds.

We opened three new stocking and distribution facilities in strategic locations that broadened our global reach and enhanced our ability to deliver CARBO Ceramics products to well drilling sites in a timely and cost-effective manner. The new facilities included stocking locations in Australia, Singapore and the United Arab Emirates.

Fittingly, Kiln 3’s addition coincided with the grand opening of the company’s Research and Product Development Center in September 2002. Perhaps even more appropriately, the piece of equipment was designed with the flexibility to run the smaller-sized products used as casting media in the foundry industry.

“Within four days, we were at full capacity and producing quality products,” Stafford was happy to report. “It was absolutely one of the quickest start-ups of a piece of equipment that I have ever seen.”

“The combination of Pinnacle’s world-class services and CARBO’s industry-leading products will expand our ability to provide production-enhancing solutions to the worldwide petroleum industry,” Pearson said after the May 2002 merger.

In 2002, less than a year after taking over as CARBO Ceramics’ President and CEO, Mark Pearson unveiled the company’s new Core Values and Mission Statement. In the few months since Jesse Orsini had handed off the leadership position, Pearson had worked in concert with his fellow CARBO executives and managers in defining the company’s philosophy.

“One of the things that Mark stated when he rolled out the Core Values and Mission Statement was that every single individual, from the shop floor to the management and executive management levels, has an absolutely vital role in this company,” said Edmunds, CARBO’s Vice President of Operations. “Every plant manager, every production manager, every QC manager and every maintenance expert brings a unique set of skills and knowledge to the table, and it’s that diversity of ideas which continues to drive value into our company.

As an excellent reference to Edmund’s statement, Vitek pointed out the launch of the company’s Research and Product Development Center in September 2002. CARBO’s Chief Financial Officer said the center – and, more importantly, the people running it – plays a vital role in one of the company’s biggest challenges ahead.

2001

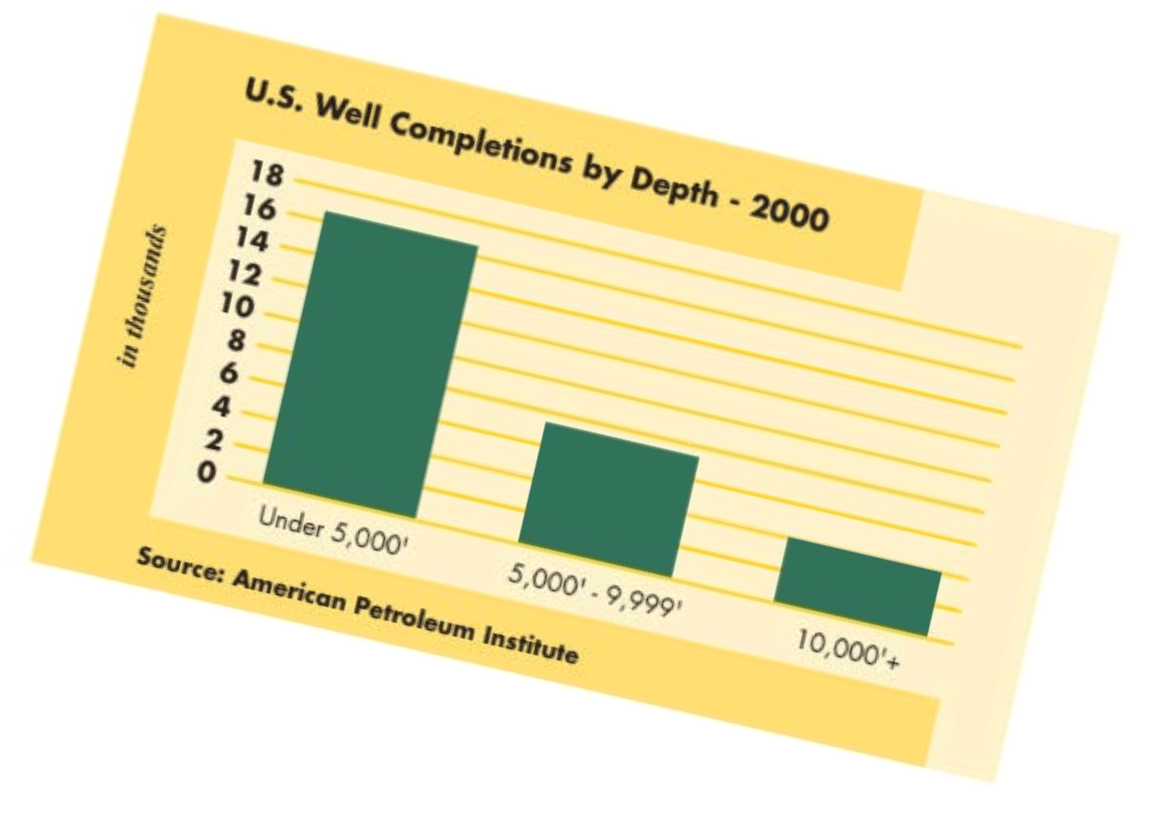

In 2000, 76% of our sales were in the U.S., Canada and Mexico. The U.S. drilling rig count increased by 47% versus the previous year, with nearly 80 percent of all wells drilled in the U.S. in 2000 targeting natural gas.

We have made great strides in improving the efficiency of our McIntyre production facility completed in 1999 and have significant production capacity available to meet increasing demand.

Our international shipments to Europe, South America, the Middle East and Asia Pacific regions increased 35% in 2000.

When worldwide drilling reached a 50-year low in 1999, our investment in a new manufacturing plant that increased our production capacity by nearly 60 percent may have appeared ill-timed. Today, that increased capacity is serving us well.

In the Green River Basin of southwestern Wyoming, a field trial with Chevron showed that hydraulically fracturing shallower wells with our ceramic proppants improved the profitability of marginally performing natural gas wells. Five wells were recompleted and hydraulically fractured using ceramic proppants at depths ranging from 6,800 to 8,500 feet. As we had forecast, the uniform size and shape of our lightweight ceramic proppants increased initial production rates in the wells by 28% and increased recovered reserves by 33 percent in the first year. The jump in production in the five wells translated into a cash flow increase of nearly $2 million in the first year alone.

We’ve opened a sales office in Houston and expanded our technical sales force to educate exploration and production companies about the compelling economic returns that ceramic proppants can provide, despite their higher initial cost.

Using well-simulation software, our sales engineers can forecast production increases and the return on investment achievable by using ceramic proppants compared with other proppants. Our computer model considers a variety of well conditions including depth, closure stress and reservoir permeability, as well as comparing the cost and performance of ceramic proppants versus other proppants.

2000

In 2000, 76% of our sales were in the U.S., Canada and Mexico. The U.S. drilling rig count increased by 47% versus the previous year, with nearly 80% of all wells drilled in the U.S. in 2000 targeting natural gas.

We made great strides in improving the efficiency of our McIntyre production facility completed in 1999 and had significant production capacity available to meet increasing demand.

Our international shipments to Europe, South America, the Middle East and Asia Pacific regions increased 35% in 2000.

When worldwide drilling reached a 50-year low in 1999, our investment in a new manufacturing plant that increased our production capacity by nearly 60% may have appeared ill-timed. Today, that increased capacity is serving us well.

In the Green River Basin of southwestern Wyoming, a field trial with Chevron showed that hydraulically fracturing shallower wells with our ceramic proppants improved the profitability of marginally performing natural gas wells. Five wells were recompleted and hydraulically fractured using ceramic proppants at depths ranging from 6,800 to 8,500 feet. As we had forecast, the uniform size and shape of our lightweight ceramic proppants increased initial production rates in the wells by 28% and increased recovered reserves by 33% in the first year. The jump in production in the five wells translated into a cash flow increase of nearly $2 million in the first year alone.

We’ve opened a sales office in Houston and expanded our technical sales force to educate exploration and production companies about the compelling economic returns that ceramic proppants can provide, despite their higher initial cost.

Using well-simulation software, our sales engineers can forecasted production increases and the return on investment achievable by using ceramic proppants compared with other proppants. Our computer model considered a variety of well conditions including depth, closure stress and reservoir permeability, as well as comparing the cost and performance of ceramic proppants versus other proppants.

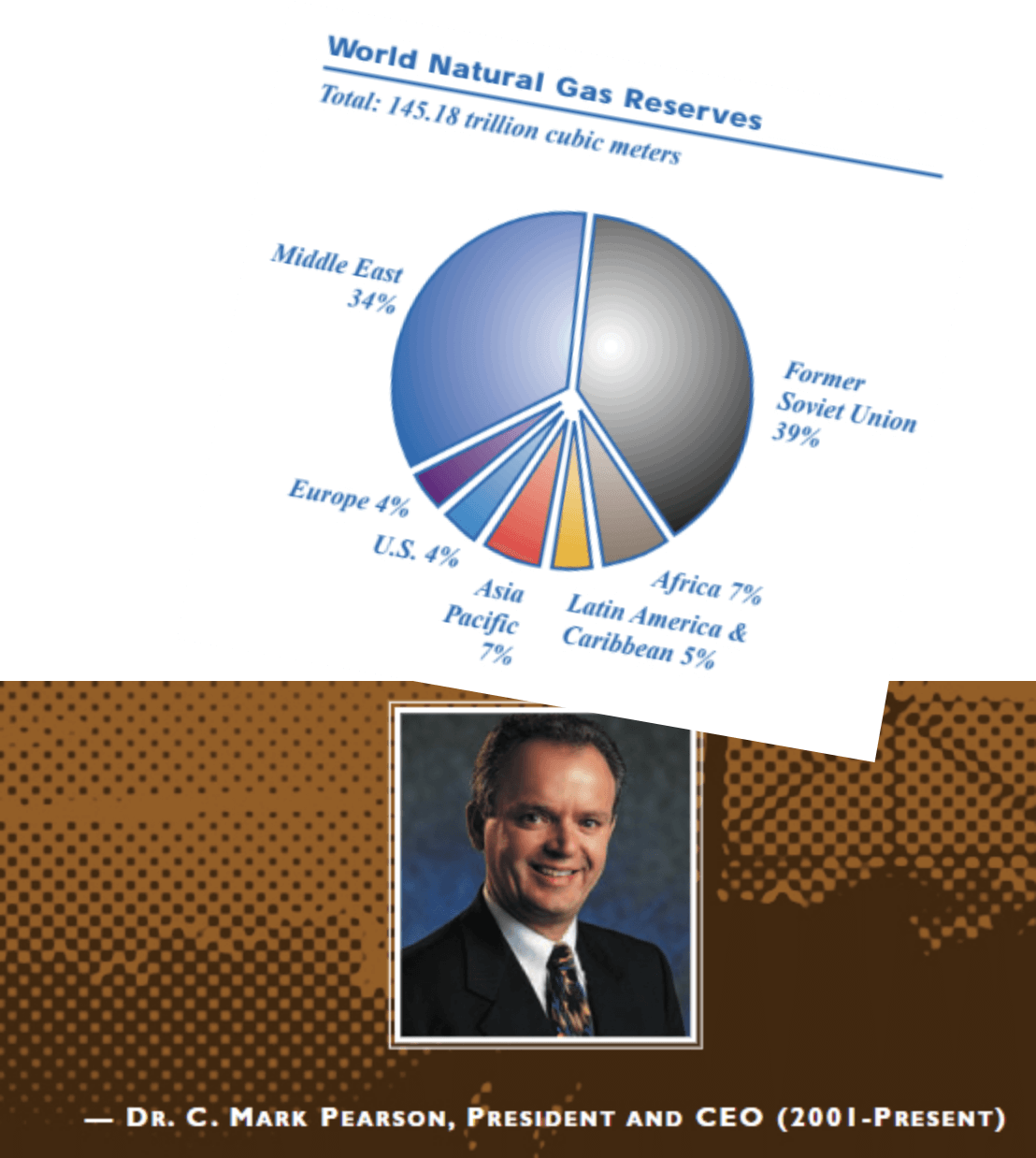

In response to the growing demand for our products in the Asia Pacific markets, we analyzed the feasibility of building a plant in China, a country with abundant supplies of kaolin and bauxite and a growing demand for high-quality ceramic proppants.

We obtainined engineering and cost estimates for a China plant with an annual capacity of 30 to 40 million pounds that could be in production by 2003. A plant in China would considerably shorten shipping times and reduce shipping costs to serve the growing markets in China, Southeast Asia, Australia and Russia.

Completed in mid-1999, our new facility in McIntyre, Georgia, was fully operational and running efficiently, making us the largest ceramic proppant producer by a considerable margin.

Our distribution system was the best in the industry. We had storage and distribution facilities in all major North American markets, allowing us to provide just-in-time delivery to our customers’ wellsites. We were constructing a second distribution facility in Canada to support the increased drilling activity in the northwest region of Alberta and we are expanding the capacity of our stocking facility in Rock Springs, Wyoming.

In 2000, after CARBO went through a secondary public offering and became listed on the New York Stock Exchange, he was looking for “CRR” instead.

FracproPT ® was the first commercial industry simulator in the year 2000 that incorporated proppant conductivity corrections for multi-phase and non-Darcy flow effects on production. These two effects were largely neglected by the oil and gas industry until CARBO Ceramics trumpeted their importance.

1999

Two years later – after recognizing that, instead of selling little pellets that held up under high stress, the company actually sold pellets that allowed a greater amount of oil and gas to flow between them – CARBO’s campaign became… Ignore the stress. Just go with the flow.

“That was really the start of a new technical marketing campaign,” Pearson says. It also marked the beginning of the growth of a new era at CARBO Ceramics.

1998

After nineteen months of construction and significantly over budget, the Georgia facility was still scrambling to get up to speed. Proper pellet formation was only one of the problems the crew encountered en route to becoming the first CARBO facility to manufacture both heavyweight and lightweight product lines. Through an arduous two-year testing process, the bigger mixers had to be fine-tuned.

“It was a long, grueling start-up, to say the least. It seemed like every piece of equipment in that plant had to be modified from the way it was originally installed, and finding a way to make good pellets with these mixers took some time,” said Canova, who was in charge of technical services and development for the plant. “But once we had everything fired up – the ball mills running and the mixers going – it was only a matter of time before we finally had good CarboProp® product coming out of the plant… which just so happened to be better than anything that had been made at CARBO Ceramics,” he added proudly.

The little plant that “couldn’t” suddenly became a high-performance, low-cost and full-capacity producer.

In 1998, Pearson extended Wright an invitation to come to Dallas, so that he could share the Pinnacle Technologies’ story with Jesse Orsini. Extremely passionate about his business, Wright delighted in relaying the company’s history and growth to CARBO’s President and CEO. Thoroughly impressed – both with the company that provided award-winning fracture mapping and groundbreaking reservoir monitoring technologies, as well as its leader – Orsini got out his flipcharts and, in return, shared the CARBO Ceramics story with his visitor.

“I was floored,” Wright recalls. “I had never heard a story of such growth in an industry that was basically cyclical with little underlying growth. But for 20 years, it had grown, grown, grown, and I was also fascinated by our similar cultures of bringing in and retaining such exceptional people. “I went home a few days later and bought stock in the company.”

Four years later – about a year after Pearson succeeded the retiring Orsini as President and CEO – the two companies signed an agreement in which CARBO acquired Pinnacle’s outstanding stock in exchange for cash and some of its own stock. While continuing as president for the company he had founded a decade before, Wright also became a Vice President of CARBO Ceramics.

“The combination of Pinnacle’s world-class services and CARBO’s industry-leading products will expand our ability to provide production-enhancing solutions to the worldwide petroleum industry.” — Mark Pearson

1997

The oil and gas industry was experiencing a mini-boom at the time. Only 30 days after Pearson’s hiring as the company’s new Vice President of Marketing and Technology, as a matter of fact, for the first time in its history CARBO shipped 30 million pounds of proppant in a month. Which translates into roughly a million pounds a day.

“It clearly had nothing to do with me,” Pearson said with a smile. “But it was interesting to come in as the Vice President of Marketing and within one month set a new sales record, and then to be sold out of product for the next 18 months.”

“I guess you could say it was just good timing.”

This was in the midst of all the trials and tribulations of the plant’s start-up operations, especially after what Canova describes as “36-hour workdays, and coming home sweaty and caked with mud in every pore of your body.” And since the news of the latest setback was being delivered by the easygoing Jimmy Wood, the Research and Development technician from Eufaula who had been sent over to assist in the start-up, Canova and the rest of the McIntyre crew couldn’t help but laugh.